New Western is committed to delivering opportunities to aspiring investors and keeping them well-informed with timely and relevant content that follows strict editorial integrity.

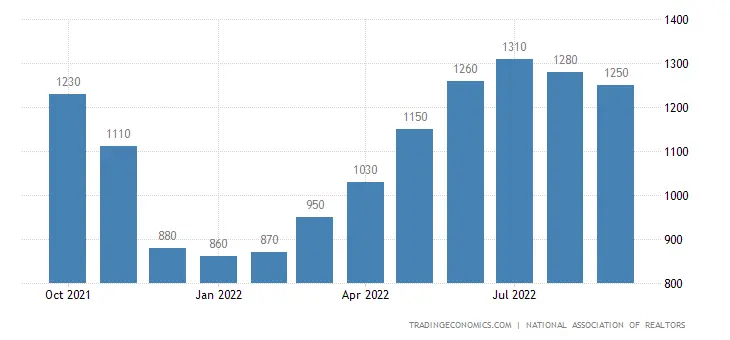

Credit: Trading Economics || NAR

In this guide, we’ll share the key factors that may indicate it’s a good time to sell a rental property. We’ll walk you through the tax implications of selling an investment property, how to proceed with the sale if the property is occupied by a tenant, and more.

Warren Buffett’s net worth is approaching the $100 billion dollar mark and, while he himself doesn’t invest in real estate (although Berkshire Hathaway’s HomeServices of America is the ( largest brokerage firm in the world), his rules for investing still apply.

In terms of real estate investing, buy-and-hold real estate strategies should be treated like a fine wine. The longer you have it, the better. Or, like Buffett says:

That said, there are times when selling a rental property would be in your best interest. But, when is that?

We asked three real estate professionals what are some key factors that an investor should take into consideration before selling a rental property. Here are their responses:

"A strong seller's market is the best and most efficient time to sell their investment property for a higher return."

"At present, about 51% of consumers believe that it is the right time to sell owing to the dominant seller's market. Generally, a good time to sell is when supply is short and interest rates are low."

Note: Mr. Capozzolo was interviewed in August 2022 when interest rates were 5.55%.

While it isn’t the lowest rate in the history of the United States (which was 2.88% in December 2020), it’s still lower than 7.09%, as of November 2022.

- Mr. Alex Capozzolo, the co-founder of Brotherly Love Real Estate

"Selling an investment property requires thoughtful consideration of (a) redeploying the proceeds of the sale to another investment; (b) receiving a good price relative to the original acquisition price. In the current economic environment, just obtaining a reasonable sale price is necessary but not sufficient as the purchasing power of cash received from the sale is diminishing due to inflation."

"Therefore, the proceeds of the sale should be reinvested. Only experienced investors can navigate the transition to purchasing another property while the sale is finalized."

- Mr. Al Lord, the Founder and CEO of Lexerd Capital Management

"There is no simple answer to this. You pull out your pencil and calculate your ROI [but] in general, it’s in your best interest to sell during a seller’s market; however, if that property is killing it for you on return and revenue, keep it!"

- Mr. Eric Bryant, the Director of Operations USA at Openn

In 2021, home prices rose by a staggering 17.8%, which would explain why 6.9 million homes were sold during that period. Homeowners and investors saw an opportunity to cash in and, boy was it a great time to do so!

CoreLogic revealed that homeowners with mortgages have seen their equity increase by $3.6 trillion since Q2 2021. The average homeowner saw their equity increase by $60,000 over a 12-month period from Q2 2021 to Q2 2022.

Credit: CoreLogic

It’s worth noting that homeowners in states like Hawaii ($129,800), California ($117,000), and Florida ($100,000) saw the largest equity gains, while Iowa ($17,600) and Washington DC ($16,900) saw the lowest gains.

Even though homeowners in some areas saw a meager increase in home equity, small gains are better than no gains.

Credit: CoreLogic

You probably have a thorough understanding of the ongoing responsibilities that come with managing a rental property since you’re a landlord.

However, the unfortunate aspect of being a landlord is that you’re basically on call 24/7 if there’s an urgent repair that needs to be addressed.

If you’re going to hire a property management company to handle your rentals, then this isn’t going to be too much of a headache. The property management company will handle most of the calls from the tenants.

However, if you plan on going to manage the property yourself, that means that when the hot water heater blows and water is gushing in the basement at 3 AM, you’re going to have to leap into action and get a repairman out there ASAP. If your tenant is locked out, they’re going to call you for help.

Then that’s not even accounting if your tenants don’t pay rent, you have to try to collect rent, start the eviction process, and so much more.

When you pile all of that on top of your regular 9-to-5… That kind of stress can be a lot to deal with if you have multiple properties or if you already have a lot on your plate.

A common mistake new investors make is to overestimate their earning potential for the property. They assume that the rental will be occupied for the whole year, but that’s never a guarantee.

Even if you have great tenants that have lived in the unit for several years, life happens, as evident from the 2020 COVID pandemic.

If your rental property is experiencing a negative cash flow for a month or two, that doesn’t necessarily mean you should go ahead and put the property on the market.

If you’re able to get to the root cause, you may be able to ride it out and focus your energy on making the most out of your rentals (maybe use this time to make improvements so you can increase rent for the next tenant).

New Western’s General Manager, Timur Medaric, points out that some investors are willing to overlook a temporary bout of negative cash flow if the equity grab proves to be profitable. If they’re able to manage the debt until they need to sell the property, then appreciation could offset the negative cash flow.

On the other hand, if there’s a prolonged vacancy or a high tenant turnover and you’re in the red for longer than your cash reserves can handle, then that’s when you might want to reconsider selling the property.

Your rental property may be performing as expected and everything is fine. Why would you consider selling a rental property that’s meeting your expectations and all is well?

One reason An investor might sell their property is for the opportunity cost. Investors are constantly presented with choices on where to put their money in order to get the best (or safest) return. The cost of passing on an investment and choosing another is the investor’s opportunity cost. In other words, it’s a trade-off.

An example of opportunity cost in the world of real estate investing would be if you had to choose between Property A which needs minor repairs, but may not be in a desirable area, and a property that needs more work in a desirable area.

While you might be able to fix and flip Property A in a short amount of time, the location could prolong its time on the market. However, if Property B is located in a desirable area, it may sell within a few days once the repairs are made.

Although you might have to spend more money to fix up Property B, the quick turn-around time could be worth it – especially if you come across a deal you can’t pass up.

When you consider it in this manner, the opportunity cost formula is fairly simple:

Missed Returns / Earned Returns = Opportunity Cost

This simple formula can help an investor decide what to do in a number of different situations. However, it’s worth noting that you should consider a number of factors before choosing an investment and figuring out opportunity costs.

These involve your investment objectives, the risks involved with each alternative, and your potential for suffering potential losses (i.e., how much risk you’re willing to take).

For a better understanding of how to measure the opportunity cost of a real estate investment, look at the examples below.

Scenario #1: Investing in Real Estate vs. Not Investing in Real Estate

There are various key aspects that should be considered when you’re beginning your journey into the world of real estate investing. There are so many opportunities out there, it’s incredibly easy to feel overwhelmed and just settle for whatever comes their way.

We all know how important timing can be when it comes to choosing an investment, so this might have devastating effects. Particularly in the world of real estate, it’s not hard to miss out on a great opportunity if you’re hesitant to bite the bullet and invest in it.

If you think about it, the opportunity cost of doing nothing is real. Consider a situation where you have $50,000 saved for investments but later decide to leave the cash in the bank.

In this scenario, you forgo the advantages of buying an investment property, on top of the money you could have made (the ROI), all because you were hesitant to put yourself through the “headaches” that go along with owning said rental property.

Scenario #2: Investing in One Area vs. Another

Let’s say you invested $50,000 in real estate. How would you determine the opportunity cost of making different choices? One of the most important considerations is when a rental property’s location has a significant impact on the earnings you can expect from it.

The various factors that play a role in determining which area to invest in include things like the demand for rentals, job growth, rate of appreciation, and rental rates. When taking these factors into mind, it’s no wonder that some areas are more appealing to real estate investors than others.

Consider a situation where you reside in Orlando, Florida, and want to buy an investment property. While Orlando is one of the best places to invest, there are other great markets in the state worth considering.

For example, properties in Lakeland, Florida, have an appreciation rate of 5.94%. Although the median household income in the area is $40,000, the rental demand is quite strong since most cannot afford to buy.

Another example is Tampa, Florida. Mosaic, Bloomin’ Brands, Masonite International, Primo Water Corporation, and Sykes Enterprises all have their headquarters in Tampa, which is good news for people who want to find better jobs.

Also, investors can buy properties at lower rates now due to affordable real estate prices and rent them at a higher price to new residents who have migrated to the city.

Scenario #3: Choosing to Invest in One Property vs. Another Property

The opportunity cost would be the return you would have received if you had chosen to invest in a different kind of property instead of the type you ultimately choose.

Let’s say you’re on the fence and don’t know which you should buy; a single-family property or a condominium. If you go with the condo, you could generate $1,000 in profit. But, you have to deal with HOA and you’d rather manage your property yourself. So, you choose to go with the single-family home, but it’ll only generate $700 in profits.

You can determine the opportunity cost by using the formula above: $700/$1,000 equals $1.4 in lost opportunity. What this means is that if you invest in the single-family home, you’re losing $1.40 on every dollar you could have gained from the condo.

Scenario #4: Investing in a Long-term Rental vs. a Short-Term Rental

The opportunity cost equation is another tool used by savvy real estate investors to assess which type of rental method is favorable: a traditional long-term rental or a short-term rental like Airbnb.

Suppose you already own a rental property and you discover that it can bring in $1,700 per month if it’s a traditional long-term rental, but if turned into a short-term Airbnb rental, it has the potential to bring in $2,000 per month.

You could choose to stick with the traditional rental method because it’s a safer investment and you’re not keen on the higher risks that are associated with a short-term rental. What is this real estate investment’s potential cost?

Divide the total returns you’re giving up ($2,000) by the profits your chosen investment will bring in ($1,700). The less profitable investment has an opportunity cost of $1.17.

Again, this implies that you might have been earning $1.17 from the short-term rental for every dollar you would have made from it as a long-term rental.

Another reason why an investor might want to sell is if they were presented with a better investment opportunity and want to “trade up,” or get a better asset through a 1031 exchange.

For a property to qualify for a 1031 exchange, as detailed by the IRS, it must:

“Both properties must be similar enough to qualify as “like-kind.” Like-kind property is property of the same nature, character or class. Quality or grade does not matter. Most real estate will be like-kind to other real estate. For example, real property that is improved with a residential rental house is like kind to vacant land. One exception for real estate is that property within the United States is not like-kind to property outside of the United States. Also, improvements that are conveyed without land are not of like kind to land.”

In other words, if you’re investing in a single-family rental property, the 1031 exchange allows you to buy and sell assets without being taxed on every sale.

You can defer related federal income tax liability and capital gains tax when you exchange one property for another.

You can read more about the 1031 exchange here.

Life likes to throw us a curve ball every so often and we have to adapt as best as we can. Life events like losing your job (or getting a new job!), expecting a new member of the family, health concerns, or just needing a sabbatical are examples of reasons why an investor may want to sell their rental properties.

Major life events can make it difficult to focus on managing your investment properties.

You could hire a property management company to manage your properties, but that would be an additional expense that may not fit into your budget or investing plan.

The costs associated with owning, managing, and maintaining an investment property aren’t cheap — not by a long shot. On top of paying the mortgage, property taxes, and utilities (granted, the tenant’s rent is usually covering this), you have to stay on top of regular maintenance tasks.

While you can do some of the repairs on your own (or with the help of an affordable handyman), larger repairs can drain your bank account pretty quickly — especially if the home was built before the 2000s, which makes up 61% of homes purchased in 2021.

To get an idea of how quickly the costs can add up, here’s a look at some common repairs in older homes.

| Feature/System | Standard Life Expectancy | Cost (Not including labor) |

| Electrical Service Panel | 60 years | $527 to $1,997 |

| Central Air Conditioning | 7 to 15 years | $100 to $500 |

| Asphalt Roof Shingles | 20 years | $5,837 – $12,635 |

| Deck | 15 years | $791 – $3,091 |

| Foundation | 100+ years | $2,153 – $7,738 |

| Garage Door | 20 to 25 years | $125 to $290 |

Source: International Association of Certified Home Inspectors

One investment strategy Mr. Medaric is fond of is cycling your properties. As he explains, an investor will “sell off the underperforming ones or even sell off the ones that are about to come due on another expensive round of upkeep and maintenance.”

If one of the major systems in the home needs to be repaired, you might have to do it again sooner than you think. According to Mr. Medaric, it would make more sense if you sell the property before you have to make those repairs again so you don’t have to pay those additional costs.

Unfortunately, many things we use today aren’t intended to last for several decades – planned obsolescence.

Along with this, an investor may want to sell their property when it begins to lose value due to one of other three types of obsolescence:

When it comes to real estate deals, the tax collector is never far behind, ready to take his cut of what is lawfully owed to the state. So when you sell a rental property, you have to pay taxes on the entire profit of the sale, called a capital gains tax and a depreciation recapture tax, whereas if you were selling a primary residence, you’d only pay taxes on a portion of the profits (if at all).

The amount of capital gains taxes you’ll have to pay will depend on how long you’ve had the property, your filing status, and your income.

Investors who sell a property they’ve owned for less than twelve months, they’ll be subjected to a short-term capital gains tax. This is taxed much like regular income and will have to pay according to their income tax bracket.

Income Tax Rate | Single Filers | Married Filing Jointly |

10% | $0 – $10,275 | $0 – $20,550 |

12% | $10,275 – $41,775 | $20,550 – $83,550 |

22% | $41,775 – $89,075 | $83,550 – $178,150 |

24% | $89,075 – $170,050 | $178,150 – $340,100 |

32% | $170,050 – $215,950 | $340,100 – $431,900 |

35% | $215,950 – $539,900 | $431,900 – $647,850 |

37% | $539,900 and up | $647,850 and up |

On the flip side, investors who sell a property they’ve owned longer than twelve months will be subjected to long-term capital gains tax. These rates are a little kinder to your wallet because the max tax rate is 20%.

| 0% Rate | 15% Rate | 20% Rate |

Single Filers | $0 – $40,400 | $40,400 – $445,850 | $445,850 and up |

Married Filing Jointly | $0 – $80,800 | $80,800 – $501,600 | $501,600 and up |

Married Filing Separately | $0 – $40,400 | $40,400 – $250,800 | $250,800 and up |

Head of Household | $0 – $54,100 | $54,100 – $473,750 | $473,750 and up |

Regardless if you’re paying a short-term or long-term capital gains tax, if you’re a high-income earner, you’ll also have to pay an additional 3.8% net investment income surtax.

“Depreciation allows an investor to allocate over time the cost associated with the use of the property. When filing for taxes the investor pays ordinary income taxes on rental income less depreciation.”

“When the property is sold, however, the depreciation that helped investors pay fewer taxes is “recaptured” that is it is added to the gains realized from the sale of property, and it is taxed as ordinary income.

Investors should be careful when they sell a property as taxes on the “recaptured depreciation” may alter the economics of the investment,” explains Mr. Lord.

As a real estate investor, you’re able to write off the property’s depreciation as an expense each tax year as long as you own the property. Unfortunately, if you ever decide to sell the rental property, the IRS will have its hand out wanting to collect that money.

Let’s say you own a rental property for five years and you claim $5,000 for depreciation each of those five years when you file taxes. When you sell, you’ll have to pay back $25,000 in depreciation recapture tax.

Despite the fact that you have kept the property for more than a year, depreciation recapture is still taxed in the same manner as your ordinary income tax.

This is caused by the fact that you were already allowed to deduct the depreciation as an expense, therefore making your taxable income from the rental property has been reduced as a result.

In addition, the IRS figures out the rate for depreciation recapture by basing it on the amount of depreciation that is allowed. This implies that an owner of the property is liable for a tax on depreciation recapture even if they never claimed deprecation as an expense.

There are a few tax loopholes that you can use to avoid paying a huge tax bill. You can even implement these strategies into your long-term investment plan. Capital gains taxes and depreciation recapture can take a big chunk out of your profits when selling a rental property.

Tax-loss harvesting is a practice that lets you offset any capital gains with losses in order to reduce the amount of tax burden you’ll be responsible for paying.

Therefore, if the value of your investment property has increased significantly during the time you’ve owned it, but the value of your stock portfolio has decreased, you might sell the stocks in your portfolio at a loss to balance the capital gains from the rental property.

If you have sufficient investment losses to offset the earnings from your investments, then this might essentially result in your capital gains tax payment being reduced to zero. This technique, of course, is based on the assumption that not all of your other assets had as successful of performance over the course of the preceding year.

In the event that everything in your portfolio performed well throughout the previous year, you might want to pursue other tax-cutting strategies to reduce the amount of money owed to the IRS. Or the advantage that it provides may not be sufficient to completely offset the financial gains that result from the sale of a rental property.

Rules for Tax Harvesting

The IRS’ Publication 550 doesn’t mention tax-loss harvesting specifically, but that doesn’t mean they don’t have rules for using this strategy. You’re required to declare the use of this strategy to the IRS using Form 8949 and Form 1040.

You may not be allowed to claim your loss if you or your spouse invests in a “substantially identical” property to the one you sold at a loss, be it 30 days before or after the sale is finalized. This is called a “wash sale” and a tax advisor can provide you with some insight into whether a property is or isn’t substantially identical.

“The best way is to buy another similar property within 180 days in what is best known as 1031 exchange which allows the avoidance of any capital gains taxes if the proceeds from the sale are invested into an equal look-like property.” Mr. Lord states.

Section 1031 of the Internal Revenue Code allows real estate investors to defer paying capital gains taxes, they only have to pay taxes once the exchange has been completed, even if you’re selling a rental property and buying another that is “like-kind.”

According to the IRS, like-kind properties are:

Properties are of like-kind if they’re of the same nature or character, even if they differ in grade or quality.

Real properties generally are of like-kind, regardless of whether they’re improved or unimproved. For example, an apartment building would generally be like-kind to another apartment building. However, real property in the United States is not like-kind to real property outside the United States.

It is not necessary for an investor to exchange one condominium for another or one company for another. As long as both of the properties generate rental income, then you can go ahead with the transaction.

However, time is essential when using this strategy since you’ll only have 45 days after the property has been sold to find suitable “like-kind” properties, and have to legally close on the properties within 180 days.

Additionally, if you have a tax return due (with extensions) earlier than the 180-day timeframe, you’re expected to close even sooner. Investors who fail to meet the deadline are then responsible for paying the whole amount of capital gains taxes owed on the sale of the initial rental property.

Real estate investors may exclude up to $500,000 (if married filing jointly) in taxable capital gains from their income by converting an investment property into their primary residence. Of course, this benefit is reduced to $250,000 for single-filing taxpayers.

For example, let’s say you have a $200,000 rental property and over the course of 10 years, it’s now valued at $300,000. If you wanted to sell that property, your capital gains would be $100,000 and the IRS would expect 15% ($15,000) or 20% ($20,000) of your profit.

Under Section 121, if you designate the investment property as a primary residence, you could reduce how much capital gains tax you’ll need to pay. In order to convert a rental into a primary residence, you must:

If you’re thinking about using one of your investment properties as a primary residence, we strongly suggest that you consult your tax advisor for guidance.

They can help you navigate depreciation recapture, how to sell for a loss, and whether or not the property was used for a qualified purpose. All of these factors will have an impact on how much capital gains can be reduced.

Under some circumstances, you may use a self-directed IRA to purchase real estate, but there are quite a few rules that you must follow:

Firstly, if you’re going to buy and own investment properties using an IRA, you’ll need to search for an “SDIRA custodian” near you, or you can view the list of IRS-approved Nonbank Trustee List or the Chamber of Commerce’s list of Best Self-Directed IRAs.

Next, you’ll need to look for a property. Fortunately, you can buy all types of real estate with your IRA. More specifically, these properties include:

Before you can purchase the property, you must find a property that adheres to the IRS’ rules regarding personal use and how you pay for things regarding the property. These rules include:

Here are a few articles you can read through to learn more about using self-directed IRAs to buy real estate:

Unlock access to our exclusive inventory of off-market investment properties.

Business isn’t about deals. It’s about relationships and we’d love to begin one with you. Interested in buying a property? Have a question about our process? Curious about a local market? Let’s talk.

When you have renters in your home, selling it may be a difficult process because tenants can be unpredictable. The way you go about selling the property largely depends on your relationship with your tenant.

Reddit is full of horror stories where a disgruntled tenant destroys the property and the landlord is out of luck because most landlord insurance policies do not cover intentional damage, aka vandalism. On the flip side, selling a rental property with a cooperative and reliable tenant could be your greatest asset.

At the heart of the matter, many investors who are interested in selling a rental property want to know how they can legally sell a property if there are tenants in it.

First and foremost, you have to take into account the tenant’s rights that have been outlined by your state. Secondly, consider what kind of lease agreement (month-to-month lease or a fixed-term lease) is in place because that’ll determine what kind of rights the tenant has.

Fixed-term leases are the most common type of lease agreement. In this agreement, the tenant is committed to living in the rental property for a fixed period of time, usually 12 to 18 months, and will pay rent during that time.

While there may be some exceptions, if a fixed-term lease is in place, the tenant has the right to live in the rental property throughout the life of the agreement, regardless if you sell the property or not.

1. Wait for the Lease to Expire

If you want to sell your property, it’s probably best to have some patience and wait until the existing lease ends before attempting to strike a deal.

This strategy requires some thought and preparation on your side, but at the end of the day, you won’t have to deal with tenants, which can make the entire process so much easier.

There are a number of major advantages to delaying the listing of a rental property until after the previous occupants have left it. For starters, the value of a rental property is often determined by how much rental income the property can generate.

In 2021, the median rent in the country increased by 17.6%, and while rent decreased by 0.2% month-over-month, rent in 2022 is up by 7.6%. Although rent doesn’t usually increase as quickly as home values, investors could be losing money if the home’s value has appreciated rapidly and outpaces the rate at that rent increases.

State with the Lowest Rent Increase 2021 – 2022 Minnesota: 5.93% | State with the Highest Rent Increase 2021 – 2022 Florida: 22.59% |

Credit: CreditKarma

Another benefit of letting the lease expire is that the home will be unoccupied. This means you can make the necessary renovations, repairs, or home improvements without being concerned about disturbing the occupants.

Plus, you don’t have to worry about potential buyers being distracted by your tenant’s clutter because it’s always in showing condition.

2. Sell the Rental With an Active Lease

A reliable tenant who pays their rent on time, has a prior lease or rental agreement, and is generally a good tenant is a valuable asset for a real estate investor, and it may increase the likelihood that they want to submit an offer on your home.

For the investor, this can be a huge selling point because they’ll save time and money by skipping the entire process of trying to find a new tenant.

It’s important to keep in mind that if you’re trying to sell a property with a tenant, you’re limiting the pool of potential buyers.

You need to make sure that potential buyers understand that there is a tenant residing in the property who has signed a fixed-term lease and that upon closing, the lease (and security deposit) will be transferred to the new owner.

3. Negotiate with the Tenant

Let’s say you’ve found someone who wants to buy the property and has the funds to complete the sale but they do not want to be a landlord and want to move into the property. You need the existing tenants to vacate the premises. What do you do?

You can negotiate with the tenant in an effort to get them to leave before the end of the lease agreement. Keep in mind that the tenant has to agree to leave because they aren’t obligated to move out on your terms.

You’ll want to be respectful and empathetic to the tenant because, let’s face it, being told you need to leave so you can sell your house isn’t an easy pill to swallow. You can soften the blow by offering to cover some of the costs of moving out early. You can do this in several ways:

4. Sell the Rental to the Existing Tenant

If your tenant loves your property, why not offer to sell it to them? It’s a win-win scenario for all parties involved. The tenant doesn’t have to move and you’re able to sell your home to someone who’ll appreciate it.

You can make this kind of deal happen in one of three ways:

5. Evoke the Early Termination Clause

Some leases will have a clause in them that will allow landlords to terminate the lease early. This clause will allow the landlord (or tenant) to terminate the lease early, as long as both the landlord and tenant agree to it when first signing the lease.

An example of an early termination clause may look something like this (as found on LawInsider.com):

EARLY TERMINATION OF LEASE. Notwithstanding any other provisions of this Lease, it is agreed between the Tenant and the Landlord that in the event the Landlord contracts with a client for the sale or lease of any of the property identified within the Lease, in conjunction with an Economic Development Project, the Landlord shall have the option of terminating this lease under the following conditions:

Note: As a landlord who may sell their rental property in the future, you might want to make sure your lease agreement includes some kind of early termination clause. Not only to protect you should you want to sell, but to ensure the potential tenant understands that you may sell sometime in the future.

A month-to-month lease has no set end date, so the agreement between the tenant and landlord automatically renews each month.

And, even if the tenant hasn’t broken any rules and has paid rent on time, the landlord can still evict the tenant, providing they give the tenant at least 30-days notice.

Some states, like New York, require up to 90-days’ notice and oddly enough, landlords in Connecticut can give tenants as little as 3 days’ notice.

We recommend reviewing Nolo.com‘s chart that outlines each state’s rules for ending month-to-month leases so you’re familiar with your state’s laws.

If the tenant is going to vacate the premises when the property is sold, it’s helpful to remember how challenging a move can be. Depending on your state’s laws, the tenant may not have a lot of time before they have to leave and they’re going to be too preoccupied with trying to find a new place to live, rather than keeping the house clean and tidy.

Even if the tenant plans to continue to live in the property, you’ll still want to make the process as easy as possible for everyone involved — the tenant included. When you’re selling a rental property with tenants, there are some ways you can help ensure the sale goes off without a hitch.

Your tenants will appreciate that you’re mindful of their schedule and you’re doing your best to cause as little disruption to their lives as possible. Inform the listing agent that the renter requires a minimum of 24 hours notice before any showings may be scheduled.

They should also be aware of when the property can and cannot be seen because the tenant will be on the premises. For example, maybe they have small children and don’t want to disrupt the nightly routine or the tenant works at night and they sleep during the morning hours.

It’s awkward for the potential buyer to walk through a home and have the person living there follow their every move. They need to be able to open cabinets, peek in closets, and be able to voice their concerns candidly without hurting anyone’s feelings.

After the showing, the appointment has been made and the tenant has been notified, ask the tenant to leave the home during the appointment.

You can give them a gift card to get some coffee or grab some lunch. Although it’s a small gesture, the potential buyer can go through and be critical of the property and the tenant gets a free coffee or lunch. It’s a win-win!

Since a tenant doesn’t have a stake in the sale of the property (and may even be in the process of moving out), it’s important that you, the seller, are willing to take some responsibility for keeping the property in show-worthy condition.

You can do that by offering to hire a cleaning company and a landscaping crew to come to the property before a potential buyer comes to the house. Not only will this give you the peace of mind of knowing that the property is neat and tidy, but the pressure is also off of the tenants to deep clean.

If you own other rental properties, you could let the renter know about any openings that are or will become available. Even if you don’t have any other rental properties they could move into, you could make some suggestions about where to look or you can ask your acquaintances if they know of any vacancies.

When renters find out that the property they are renting is going to be sold, it may come as quite a surprise to them, and many landlords are aware of this and does what they can to help ease their tenant’s worries.

Despite that, some tenants will still worry and if they feel left out of the process, they may be uncooperative and could sabotage the deal. In an effort to keep the tenant an ally and cooperative, some landlords will offer incentives to the tenant to ensure everything runs smoothly.

Here are some common incentives landlords may offer their tenants during the selling process:

Note: If you want to give your tenants an incentive or two, you should consider how it’ll affect your bottom line. More specifically, how it could impact your ability to get a future mortgage or refinance an existing mortgage because lenders typically include the income from the rental.

Regardless of the state of the market, selling a rental property may be a major pain thanks to the complicated tax regulations, the terms of any existing leases, and the general wear and tear caused by tenants. But, you have to take some action because when the moment is right, you could stand to make a lot of money from the sale without much hassle.

If this is your first time selling a rental property, we’ve compiled a list of tips that’ll help the sale go as smoothly as possible.

Your investment property has certainly gained value since you’ve owned it, which means that you could stand to earn a sizable profit.

However, since it’s been a rental property rather than your primary residence, you won’t be bypassing the capital gains tax, which means your profits (even if it’s below $250,000/$500,000) are taxable.

But, remember that there are ways to get around this — especially if you hold on to the property longer than a year (lower long-term capital gains tax) or you want to buy a new investment property (using the 1031 exchange).

Plus, if your taxable income is less than $80,000, you’re exempt from paying capital gains entirely.

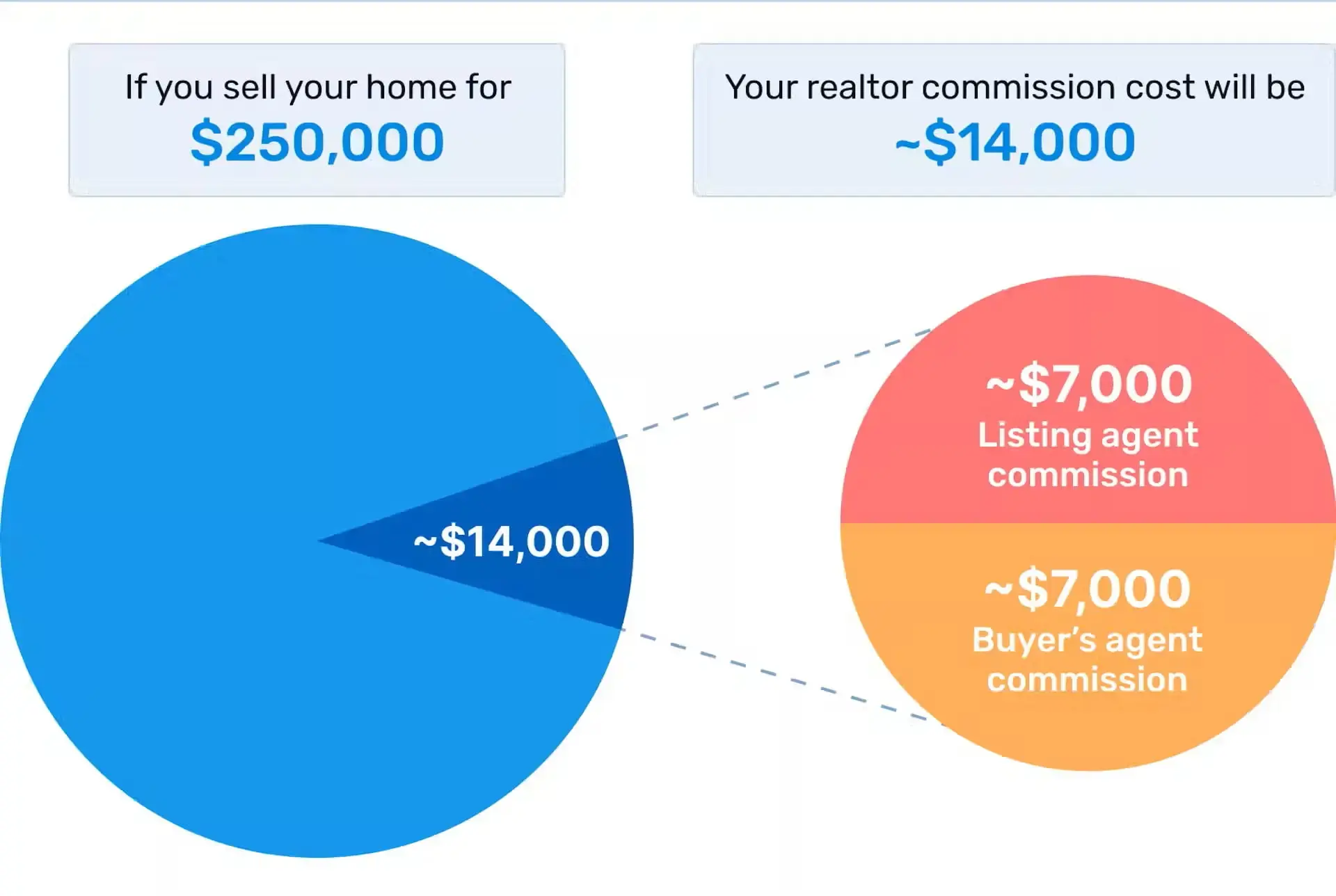

The idea of selling a rental property on your own may be tempting because you’re cutting out the middle man — the real estate agent.

Instead of paying the average commission rate of 5.37% (which is usually split between the listing agent and buyer’s agent), you’re keeping a sizable chunk of your profits.

Credit: List with Clever

But, as tempting as that may be, FSBO (for sale by owner) properties sell for 18% less than homes listed with an agent. By working with a real estate agent who is well-versed in selling investment properties, they can offer insight regarding:

Along with a real estate agent with investment property experience, you’ll also want to have a real estate attorney, a licensed contractor/home inspector, an appraiser, and a certified personal accountant.

If your home is vacant, you have the opportunity to address any repairs that need to be done, both structurally and cosmetically. The most common repairs seller’s should tackle include:

If you keep an eye on things like real estate prices and vacancy rates for rental properties, you should be able to tell if the market in your area is robust, sluggish, or lukewarm.

Even though it is hard to predict potential values for real estate in any specific town, there are a few things you can look at to get a better idea of whether or not it is a good time to sell or not. These things are as follows:

One of the most significant factors that might influence a potential buyer’s interest is whether or not there will be a rise in the property’s value over time.

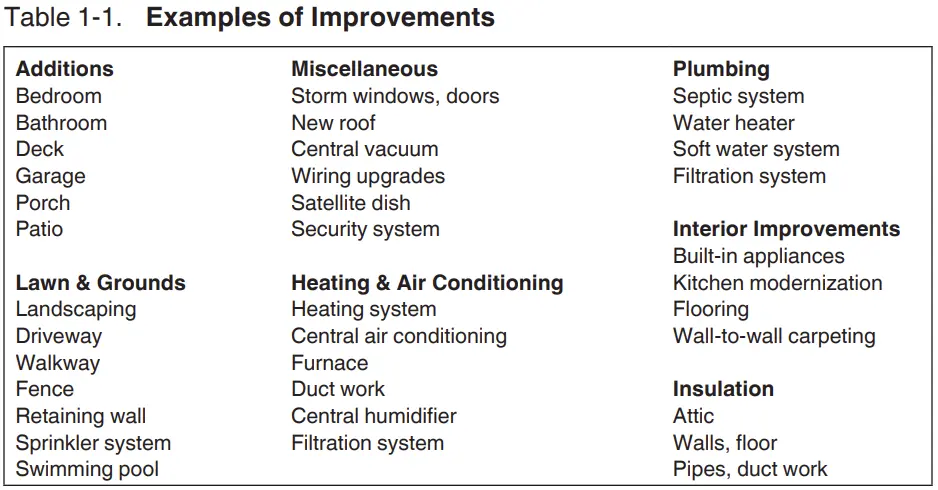

If you complete the repairs, spruce up the place, and do a few upgrades for your rental property, you’ll be able to increase the rent, which can then allow you to increase your asking price when you sell. Keep in mind that you don’t necessarily have to do any huge renovation projects.

There are many ways you can increase your property’s value without breaking the bank or tearing down any walls. These improvements can include:

Although increasing rental income is appealing to potential investors, your home may be even more favorable if you take measures that will reduce monthly costs.

Some things you can do to reduce monthly costs can include:

Did you know that 82% of real estate agents surveyed in NAR’s 2021 Profile of Home Staging say staging made it easier for buyers to envision themselves living in the home?

Not only will it help potential buyers see the home in all its glory, staged homes tend to sell quicker and for more money than plain old vacant properties.

Along with staging, you don’t want to use your smartphone to take photographs of your home! A professional photographer who specializes in real estate photography can capture the beauty of your home while minimizing the less-than-desirable aspects.

When you’re interviewing real estate agents, be sure to ask about their marketing strategy and whether or not it will include staging, professional photography, and even video walkthroughs because they can make a big difference.

A: Selling a rental property that you’ve inherited from a family member is no different than if you were selling an investment property you bought yourself. However, if you’ve inherited a property in another state, be sure to consult professionals in that state for guidance because the laws and regulations vary from state to state.

A: If your tenant files for Chapter 7 or Chapter 13 bankruptcy, the court will grant something called an “automatic stay.” This basically means that a landlord cannot bring action against the tenant (ie: eviction).

However, if the tenant neglects to pay rent after filing for bankruptcy, you can file a motion to be released from the automatic stay so you can move forward with the eviction process. We recommend consulting your real estate attorney for guidance.

A: You can pay the liens yourself using the profit you made from selling the property, but there are some investors who are willing to take on the debt and pay it for you, providing they get a discount on the price of the house.

A: There are many deductions you can claim when you’re fixing up your rental property prior to selling. As outlined by the IRS, you can deduct expenses for repairing or maintaining the property. See the chart below.

Credit: IRS Publication 527 for 2021

A: “Homes not used as primary residences such as investment properties are considered capital assets and as such at the time of sale are taxed with capital gains. The rule of 2 out of 5 ensures that no capital gains will be assessed at the individual level if the owner of this investment property has lived at a minimum of 2 out of the past 5 years in the property.” Mr. Lord explains.

A: Selling a rental property as-is is definitely an option, but it may not be the best option because you could be leaving a lot of money on the table. Some of the repairs that you can ignore but won’t hurt your bottom line include:

The agent you list with should be able to offer advice regarding the pros and cons of selling as-is and offer recommendations about what repairs you should do.

There are a lot of things investors need to take into consideration if they’re thinking about selling their investment properties. Not only do you have to be wary of the current state of the real estate market, but you also have to think about the tax implications. But, perhaps the most important consideration, is how to go about selling the property that is currently being rented.

Billionaire investor Warren Buffett says buy-and-hold real estate investing is like a fine wine – the longer you have it, the better. That said, there are times when selling a rental property would be in your best interest. But, when is that?

In a seller’s market, conditions favor sellers with faster sales, fewer price cuts, and offers very close to or even sometimes above asking listing prices.

Landlords are on call 24/7 if there’s an urgent repair that needs to be addressed. The property management company will handle most of the calls from the tenants, but if you’re self-managing, you’ll have to deal with the problem yourself — regardless of what time it is. When you pile all of that on top of your regular 9-to-5, it can be a lot to deal with.

If your rental property has experienced negative cash flow for a month or two, that doesn’t necessarily mean you should put it on the market. Some investors are willing to overlook a temporary bout of negative cash flow if the equity grab can be profitable in the long run.

An investor may decide to sell their rental property for the “opportunity cost,” which refers to the risk of missing out on profits by choosing one opportunity over another. It’s not hard to miss out on a great opportunity if you’re hesitant to invest in it. A rental property’s location has a huge impact on the earnings you can expect from it.

Along with opportunity cost, real estate investors can use a 1031 exchange to “upgrade” or “trade in” one property for like-kind property. A 1031 exchange allows you to buy and sell assets without being taxed on every sale. You can defer related federal income tax liabilities and capital gains taxes.

Major life events can make it difficult to focus on managing your investment properties, and you might want to sell your property. You could hire a property management company to take care of your properties, but that would be an extra cost that might not work with your budget or plan for investing.

An investor may want to sell their property when the repairs and regular maintenance become too expensive. They may also consider selling if it begins to lose value due to one of the other three types of obsolescence — functional obsolescence, economic obsolescence, and physical obsolescence. According to Mr. Medaric, it would make more sense if you sell the property before you have to make those repairs again.

When you sell a rental property, you have to pay taxes on the entire profit of the sale, called a capital gains tax and a depreciation recapture tax. If you’re selling a primary residence, however, you’d only be taxed on a portion of the profits (if at all).

The amount of capital gains taxes you’ll have to pay will depend on how long you’ve had the property. Investors who sell a property they’ve owned for less than twelve months will be subject to a short-term capital gains tax. If you’re a high-income earner, you’ll also need to pay an additional 3.8% net investment income surtax.

As a real estate investor, you’re able to write off the property’s depreciation as an expense each tax year as long as you own the property. When the property is sold, the depreciation that helped investors pay fewer taxes is “recaptured” and added to the gains realized from the sale of the property.

There are a few tax loopholes that you can use to avoid paying a huge tax bill. You can even implement these strategies into your long-term investment plan. Capital gains taxes and depreciation recapture can take a big chunk out of your profits when selling a rental property.

Tax-loss harvesting is a practice that lets you offset any capital gains with losses. This allows you to reduce the amount of tax burden you’ll be responsible for paying. You’re required to declare the use of this strategy to the IRS using Form 8949 and Form 1040.

Section 1031 of the Internal Revenue Code allows real estate investors to defer paying capital gains taxes. You only have to pay taxes once the exchange has been completed, even if it’s a “like-kind” property. Real property in the United States is not like-kind to real property outside the U.S.

Investors may exclude up to $500,000 in taxable capital gains from their income by converting an investment property into their primary residence. This benefit is reduced to $250,000 for single-filing taxpayers. Consult your tax advisor for guidance on how much capital gains tax you’ll need to pay.

A self-directed IRA can be used to purchase real estate. You must follow the IRS’ rules regarding personal use and how you pay for things regarding the property, as well as the costs associated with it.

Selling a rental property with a cooperative and reliable tenant could be your greatest asset. Consider what kind of lease agreement (month-to-month lease or a fixed-term lease) is in place.

A month-to-month lease is an agreement between a tenant and landlord that automatically renews each month. Even if the tenant has paid rent on time, the landlord can evict the tenant after 30 days. Some states require up to 90-days notice, others as little as 3 days.

Tenants with a fixed-term lease have the right to live in the rental property throughout the life of the agreement, regardless if you sell the property or not. Fixed-term leases are the most common type of lease agreement and are usually 12 to 18 months long.

Here are a few ways you can handle selling a rental property with tenants on a fixed-term lease agreement:

There are a number of major advantages to delaying the listing of a rental property. For starters, you won’t have to deal with tenants (ensure showings fit in with their schedule, worry about them keeping the property in showing condition, etc.), which can make the entire process so much easier.

Another benefit is that the home will be unoccupied, meaning potential buyers can focus on the property’s appearance.

A tenant who pays their rent on time has a prior lease agreement, and is generally a good tenant is a valuable asset for a real estate investor. You need to make sure that potential buyers understand that there is a tenant residing in the property and has signed a fixed-term lease.

You can negotiate with the tenant in an effort to get them to leave before the end of the lease agreement. Asking your tenants to move out earlier than anticipated is a big inconvenience. You can soften the blow by offering to cover some of the costs of moving out early.

If your tenants love the property and are interested in buying it, you can make a rent-to-own agreement. You, the seller, will continue to hold the mortgage and collect rent as usual. If the tenant/potential buyer default on their payments, it’s your responsibility to begin the foreclosure process.

As a landlord who may sell their rental property in the future, you will want to make sure your lease agreement includes some kind of early termination clause. Not only to protect you should you want to sell, but to ensure the potential tenant understands that you may sell.

When selling a rental property with tenants, there are ways you can help ensure the sale goes off without a hitch. You can plan showings around the tenant’s schedule and ask them to step out of the house during the showing.

You could hire professionals for cleaning and landscaping to ensure the property is maintained (which your tenants would probably appreciate, too!).

Here are some tips that’ll help you through the sale as smoothly as possible.

Although your investment property has gained value during the time you’ve owned it, you’re likely to receive a sizable profit. But since it’s an investment property rather than your primary home, you will have to pay the capital gains tax. If your taxable income is less than $80,000 you’ll be exempt.

Don’t fret though because there are ways to avoid this by owning the property longer than a year (the long-term capital gains tax rate tends to be lower than the short-term capital gains tax rate) or using the 1031 exchange.

Although the thought of cutting costs and going the FSBO (for sale by owner) route, it’s important to know that properties sell for 18% less than homes listed with an agent who has experience working with real estate investors.

In fact, you want to create a team of investor-savvy professionals, which include real estate attorneys, licensed contractors, and home inspectors, home appraisers. and real estate attorneys. Don’t forget that a real estate CPA can help navigate tax implications, reduce tax obligations, and optimize investments.

Prior to putting your property on the market and it’s vacant, use this as an opportunity to address any repairs (large and small) that need to be done — or be prepared to negotiate on the price if you don’t want to be bothered.

Along with the repairs, you’ll want to pressure wash the exterior of the home, the walkways, patio/deck, and driveway. You’ll also want to spruce up the interior by repainting the walls, deep-clean carpets, and refinishing hardwood floors.

It is hard to predict potential values for real estate in any specific town or city. There are a few things you can look at to get a better idea of whether or not it is a good time to sell.

These things include housing prices and vacancy rates for rental properties, as well as the local economy, and plans for future development.

If you make repairs, tidy up, and update, you can raise the rent, which can help you sell for more. There are many ways you can increase your property’s value without breaking the bank. You don’t necessarily have to do any huge renovation projects.

On the other hand, there are some ways you can minimize your expenses, such as (but not limited to), replacing old fixtures, windows, and doors with energy-efficient options.

You can reduce water consumption by installing low-flow plumbing fixtures like toilets, faucets, and shower heads.

Staging an empty house helps purchasers realize the home’s full potential and picture themselves living there. It also helps the house sell faster and for more money than homes that are completely empty. Along with staging, real estate photographers may capture your home’s attractiveness while reducing flaws.

If you are selling multiple rental properties in a year, you can save money by learning how to take real estate photos on your own.

When you decide that it’s time to put your investment property on the market, it might feel overwhelming and you may feel like you’re in over your head.

However, that doesn’t have to be the case at all. We hope that this guide gives you some reassurance regarding your options, but it’s just the tip of the iceberg.

You can send us an email if you have more questions about selling a rental property or anything related to real estate investing — we’re happy to help!

Unlock access to our exclusive inventory of off-market investment properties.

Business isn’t about deals. It’s about relationships and we’d love to begin one with you. Interested in buying a property? Have a question about our process? Curious about a local market? Let’s talk.