Written by The New Western Team

New Western is committed to delivering opportunities to aspiring investors and keeping them well-informed with timely and relevant content that follows strict editorial integrity.

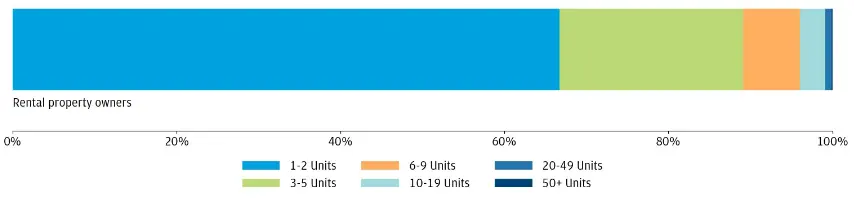

Did you know that, despite there being more than 834,000 people who work in rental property management, 45% of landlords choose to manage their properties on their own?

Considering that 89% of individual investor landlords own five investment properties or less, how hard is it to manage the properties yourself?

What’s the point of hiring a rental property management company when you can do it yourself? That’s just one more expense that you might not be willing to pay.

Credit: JPMorgan Chase

Even though the U.S. Census Bureau shows that occupancy dropped by 0.3% in the third quarter of 2021, the single-family rental market is still operating at 95%.

So, while managing one or two properties yourself may seem easy enough, once you have three (or more) occupied properties, don’t be surprised if you feel busy.

You don’t have to do it alone. There’s a reason why there are so many professionals who work in property management.

They’re here to help you manage your investment properties so you can continue to focus on the other important things in your life.

If you’re a homeowner, you’re all too familiar with the headaches of owning property. You have to pay the bills, keep up with yard work, make repairs, and eventually tackle home renovations. All of these costs can add up, and pretty quickly.

Now, just imagine needing to take care of properties that you don’t even live in. Can you imagine remembering to send out multiple mortgage payments, water bills, homeowner’s insurance bills, and the like?

A rental property management company handles that and so much more.

Property management is when a third party takes care of the tasks of running a residential, commercial, or industrial real estate property.

They are tasked with carrying out the duties delegated to them by the property’s owner while preserving the value of the property and ensuring it generates income.

Property management companies can manage many types of rental properties.

Residential property management companies are often hired to manage a variety of investment properties. They can be hired to oversee can include:

Owners of commercial properties have different needs than residential property owners.

They’ll hire a property management company that understands the intricacies of managing commercial properties like:

Industrial property management isn’t the same as commercial property management. Instead of managing stores, restaurants, or office buildings, an investment property management company will oversee:

The duties of a property management company can be wildly different depending on what type of properties they’re managing.

A residential property manager is responsible for:

Property managers of commercial or industrial properties have very similar responsibilities:

When it comes to how much it costs to hire a property management company, it can vary from company to company.

There are some companies that will charge a percentage of the property’s monthly rent — usually between 8% to 12%, whereas other companies will charge a flat fee.

According to Thumbtack, the cost to hire a rental property management company ranges between $69 per month to $225 per month; the national average is around $99 per month.

Credit: Thumbtack

That said, property managers may charge additional fees, which will be taken out of the property owner’s rental income. These additional fees may include:

Most property management companies will charge a one-time setup fee. The fee can vary from company to company, but it’s usually a flat rate instead of a percentage of the monthly rent. This fee covers:

Note: Property managers for commercial properties may charge a higher setup fee due to the extra paperwork that’s often required.

The leasing fee (sometimes called a placing fee) is in reference to the costs associated with finding a tenant for your rental property.

This includes marketing the property, reviewing applications, screening potential tenants, drawing up leases, and getting the property ready for occupancy.

This fee varies from company to company. Sometimes it will be a flat fee and sometimes it can be a percentage of the first month’s rent.

Although it’s uncommon, some property management companies will charge a vacancy fee until the property is rented.

Why do they charge a fee for overseeing a vacant property? Well, the electricity still needs to be on (in the property management company’s name) for showings, there may be a leak, and needs to be repaired.

On top of that, the longer the property is vacant, the higher the risk of a break-in or vandalism. This means the property manager may have to stop by the property a couple of times a week to check on things.

The fee can be as low as $50 to $75. Be aware that if the management company takes a percentage of the monthly rent to cover their basic fees, then there’s a possibility that you’ll see this type of charge.

Late fees are charged to the tenant if they pay their rent later than the due date or grace period that’s listed in their lease agreement.

Some states have laws that regulate how much the landlord can charge and how long they must wait before imposing that fee on the tenant while others do not.

As a general rule, when a tenant pays their rent late, they are charged a late fee (usually no more than 5% of the monthly rent). So for a $2,200 per month rent, they would be charged $110.

The property management company may keep a percentage of that additional money or it may go directly to the property’s owner. That is something that will have to be discussed between the property owner and the management company prior to signing any contracts.

Most established property management companies will have a network of handymen, contractors, and vendors they can call on whenever one of the properties they manage has a problem.

This is great news for the property owner because the cost of repairs should be lower than if you were to contact a contractor yourself.

However, the management company may charge you a small percentage simply for going through the process of finding a contractor and arranging a time that works for both the tenant and contractor so the repairs can be made.

When a tenant decides to renew their lease, the property manager may charge a lease renewal fee because they’re drawing up new leases, calculating fees if rent has increased, and so on.

This fee can be a flat fee or a percentage of the monthly rent.

Evicting a tenant is a lengthy process that may require going to court. As a result, a property management company may charge an eviction fee depending on the effort it takes to resolve the problem.

On average, the cost to go through an eviction is approximately $3,500 and it can take more than 4 weeks to process.

If a property owner wants to terminate their contract with a property manager for one reason or another, they may be charged a fee.

This is another item that you’ll want to discuss with a property manager before signing any contracts.

After reading through all of the fees that a rental property management company could charge you, it’s understandable that you’d come to the conclusion that you can save a lot of money when you self-manage — be a landlord.

But, people often wonder how different the responsibilities are between a landlord and a property manager. Let’s break down the basics of self-management.

Self-management basically means you’re the owner of a property and you’re managing your rental property without any outside help. You are their go-to for things like paying rent, submitting maintenance requests, and the like.

If you’re considering taking the hands-on approach with your investment property, you’ll need to weigh the pros and cons associated with self-management.

1. You’re In Control of Your Investment.

As a landlord, you are in control of everything that goes on with your property. You will be the one who’s in charge of finding and screening tenants, collecting rent, addressing maintenance concerns, and managing the finances.

Since you’re in control, you can make decisions that can help you achieve your investment goals. Plus, since there isn’t any middleman (the property manager), that’s more money in your pocket.

2. You’re Gaining First-Hand Experience Running a Rental Business

When you’re handling your own rental properties, you’re developing your skills in real-time. There will be some bumps along the way, to be sure, but real estate investing forums and real estate investor Facebook groups are excellent sources of support and advice.

As you learn the industry and become more confident, you have the option of expanding your investment portfolio. You might even decide to open a property management company of your own.

3. You’re Going to Work Hard to Manage Your Property Well

When your money and reputation are on the line, you’re going to do your best to make sure everything runs smoothly.

You’re going to go the extra mile to find a reliable tenant who pays their rent on time and will treat your property like their own.

If there are any maintenance issues, you aren’t going to hire just any contractor with the lowest prices. You’ll take the time to find someone who comes highly recommended, even if you might have to pay a little more for their services.

4. Your Property Is In Good Hands

If you want to hire a rental property management company to manage your property, there’s no guarantee that they will take good care of your property. But when you manage your own property, you know for a fact that your property will be taken care of.

1. You’re Always on the Clock

Unfortunately, managing a rental property is a demanding job and you’re expected to be available 24/7. Should a pipe burst under the shower or tub, at 3 a.m., your tenant is going to call you and expect you to handle the situation right away.

2. You Need to Learn Landlord-Tenant Laws

As a landlord, you need to know your state landlord-tenant laws and abide by them. There are a lot of laws and it can be incredibly time-consuming trying to wrap your head around each and every one.

Some of the laws you must learn, include (but are not limited to):

3. Screening Tenants Can Be Tricky

Unless you know the person you’re going to rent to personally, you have to take the time to screen potential tenants.

This can be quite time-consuming if you have a lot of applicants! And if this is your first time managing a rental property, there’s a chance of renting to a bad tenant.

What makes someone a bad tenant? A bad tenant:

To find quality tenants, follow these steps:

Credit: Fit Small Business

4. You Have to Collect Rent and Handle Evictions On Your Own

Since you’re doing this on your own, you will be responsible for collecting rent. That’s fine when your tenant pays rent on time every month, but when they’re paying rent late every month despite countless warnings… You might consider beginning the eviction process, which can be quite time-consuming and expensive.

The costs to evict are going to vary from state to state, but for an uncontested eviction, the breakdown may look something like this:

Business isn’t about deals. It’s about relationships and we’d love to begin one with you. Interested in buying a property? Have a question about our process? Curious about a local market? Let’s talk.

There is no universally accepted way of defining a good rental property; nonetheless, there are a number of signs and benchmarks that may help you determine whether or not a certain property is a desirable addition to your investment portfolio.

"With managing a rental property on your own, comes headaches and hassles.

- Finding quality tenants

You are responsible for everything starting from finding prospective tenants to vetting them to drafting the lease agreement, running credit checks, to handing over the keys. There is no break.

- Protecting the property

You may find the tidiest of all tenants, but accidents do happen. When you're handling everything alone, you're handling everything else.

- Full-time availability

When you act as your own property manager, there is no 9 to 5. You will receive calls, texts, etc about emergencies all the time.

- Collecting rent

Asking people for money is not enjoyed by everyone. But, by being your own property manager you will have to get comfortable with it. And if someone does not pay on time, you may have to go for door duty."

- Mr. Alex Capozzolo, the co-founder of Brotherly Love Real Estate

"It’s a 24/7 job. Tenants are amazing people, but they’re also needy. Sometimes you have to remind them, something that is a crisis to you, is not my emergency."

"Of course, you need to make sure your properties are safe and habitable, but you’re going to lose sleep the first time someone’s washing machine leaks at 3am. You’d better hope your coffee machine is still working when you need that middle of the night wake up."

- Mr. John Maxim, entrepreneur, expert house flipper, and founder of multiple 7-figure businesses.

"With a renter, you simply never know who you are going to get and it’s impossible to tell their personality from a credit report or paystub. Things can go south quite fast!"

"#1 Biggest headache: Dealing with collections and evictions. When a tenant stops paying (especially during this last Covid period when there is no recourse for not paying your rent) the average landlord doesn’t deal with this in a professional manner or they don’t know how to deal with it at all. They either don’t like confrontation and ignore it or allow the tenant to make excuses and get further and further behind on the rent or they are emotional and start harassing the tenant, going to the property, sending threats, etc. Neither of these are good scenarios."

"2nd biggest headache: Repairs – Vendors, whether it be plumbers, electricians, gardeners have always been a bit hard to rely on… whether it’s a no-show, or they do show and never get back to you with a bid, or they do work but it wasn’t done correctly, etc. etc. It’s 100 x worse now with the staff shortages and supply chain nightmares. Fixing a simple issue for a tenant can turn into a full-time job for a landlord who doesn’t have solid vendors at their disposal."

- Ms. Mia Sophia Melle, President and Founder of Modern Real Estate Shop

The general consensus from our experts is that managing a rental property on your own can be a lot of hard work with quite a few headaches. But, will everything run smoothly if you have a property manager running the show?

As with everything in life, there are pros and cons that you’ll need to take into consideration.

1. The Property Manager Knows What They’re Doing

There’s a lot more to managing a rental property than you’d realize and for this being your first investment property, it’s going to be a lot to wrap your head around.

However, when you hire a property manager to handle your property, you don’t have to worry about very much (if any at all) because the property manager knows the ins and outs of the industry.

With the right property management company, you can trust that your investment will be in good hands.

2. You Can Focus on Other Things

Managing a single rental property is a lot, just imagine how much more work it is when you have more than one rental. Working with a property manager can free up a lot of your time.

That means you can begin expanding your rental portfolio and make offers on new investment properties for sale, or whatever other investment opportunities may pique your interest.

3. Maintenance Problems Can Be Addressed Quicker

Depending on the company you hire, they may have maintenance staff on hand, 24/7. Whenever your tenants have a problem, you can trust that the issue will be addressed and remedied quickly and efficiently.

If the company doesn’t have an on-staff maintenance team, then they’ll at least have a roster of qualified contractors and vendors who can go to the property quickly and make the necessary repairs without costing an arm and leg.

4. Your Property Is Less Likely to Go Vacant for Long

Marketing your property when there’s a vacancy is incredibly important because the longer your unit is vacant, that’s less money in your pocket. A property manager has the tools and skills to effectively market your property to ensure a quick tenant turnover.

Property managers have a tried and true method for screening potential tenants. They’re able to get a tenant credit report to assess the likelihood that they’ll pay rent on time. They can do background checks, criminal checks, and so on, whereas finding this information on your own may not be as easy.

1. You’re Hands Off, But Not Entirely

Some investors may like having someone else deal with all the aspects of property management. But for those who prefer to have more control, hiring a property manager may not be right for them.

That said, a good property management company should be able to ease any concerns someone may have about leaving their property in someone else’s hands.

2. The Property Manager Will Take a Portion of Your Rental Income

Hiring a property management company to handle your investment will cost you, there’s no way around that. Of course, it’s understandable that you’d want to pay as little as possible, remember that you get what you pay for.

3. There’s a Chance of Hiring a Bad Property Management Company

When your money is on the line, you need to thoroughly vet the company that’s going to be managing your property.

Right off the bat, a company may seem like they’re a good fit (they’re personable, they manage many properties, and appear to be professional), but don’t be deceived!

Our experts highlight some of the red flags new investors should be on the lookout for:

Mr. Capozollo: “There are pros and cons to everything. Investors must keep an eye out for these red flags: cancellation clauses, inactive license, number of staff, and fee structure.”

Mr. Maxim: “Communication is everything. The big red flag is a company that doesn’t get back to you. If they can’t get back to you about new business, how are they going to handle a crisis at your property.”

Ms. Melle: “There are some critical red flags a landlord can look out for when looking for a property management firm. Some questions to ask yourself are:

1. Is the company responsive? When you make your initial inquiry, did someone pick up the phone? Did you have to leave a voicemail? Did anyone call you back? If the firm is not responsive to a new landlord inquiry, they are not going to be responsive to your tenant with a repair request or a payment issue, or to you when you have a question or concern once you are signed up.

2. Is property management their main gig? If the company has a very generic template website and all stock photos that may be a sign that they do not have actual staff to highlight on their site or they may not have any actual properties to list. A lack of authenticity and specificity on their site may show their focus is elsewhere or they have no focus both of which would be red flags.

3. Are they established? The property management company should have a professional permanent location that is well maintained for tenants to pay rent and come in to talk. A run-down office, a “professional” building where companies come and go out of very easily is a red flag that this is not an established business. Sometimes you will even find a street address is just a mailbox in a postal center… It’s a huge red flag.”

A big question people often have is when is it necessary to hire a property management company.

Some people think that since they only have one rental property, then they don’t necessarily need to spend the extra money to have a property manager.

However, our experts agree that investors should work with a rental property management company early.

Mr. Capozollo: “Seeking assistance from a property management company is generally beneficial even in the case of fewer properties. The investor is free from hassles that will be taken care of by the property manager. Spending a little amount for a property management company is a small investment that offers higher returns. Since the investor is going to be free from the duties of managing the properties, they can invest this time in expanding their portfolio and bettering their investments.”

Mr. Maxim: “Honestly, I think all new investors should consider a property management company the first time out. You have absolutely no idea what to expect. You’re a rookie. This is the big leagues. Call the professionals early, instead of in an emergency. You can also control your level of communication with the property management company. If this is your first rodeo, you’re going to want to hear about every buck and bull.”

Ms. Melle: “We are talking about an asset that is worth hundreds of thousands of dollars and having a partnership with a company that can contribute professionalism, expertise, and boots-on-the-ground resources to manage, maintain and maximize that investment is critical. Especially considering that with an average of 5-8% of the gross rents monthly, the cost of property management is incredibly affordable not to take advantage of.”

“In addition, there are so many new laws that have been put in place over the last 2 years you need an expert more than ever to make sense of them and stay in compliance. The tenant also tends to behave in a more professional manner when they know a company is involved as opposed to dealing with the owner directly. We do not get swayed by emotion or manipulated by excuses.”

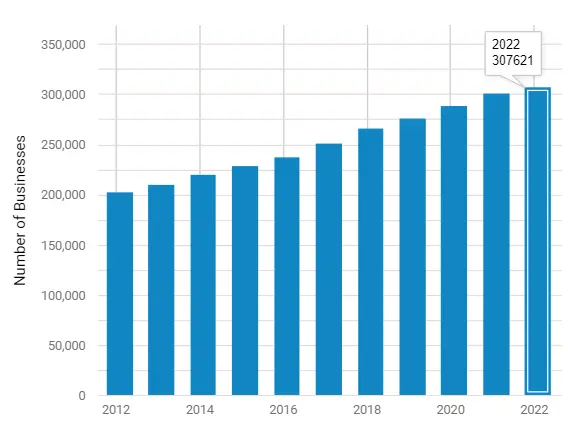

With there being more than 307,000 registered property management companies operating in the United States, it might be hard to figure out which company to hire. You certainly don’t want to hire the company with the cheapest rates because, as we said, you get what you pay for.

Credit: Ibis World

So, what should you look for in a property management company?

Ms. Melle advises, “You want to look for a company that has been around for a while and has years of specific experience dealing with tenants and rental property. The tenant/landlord laws have changed a great deal and are very complicated and different than they used to be. A good company will be on top of the changes and be able to guide the landlord to stay in compliance.”

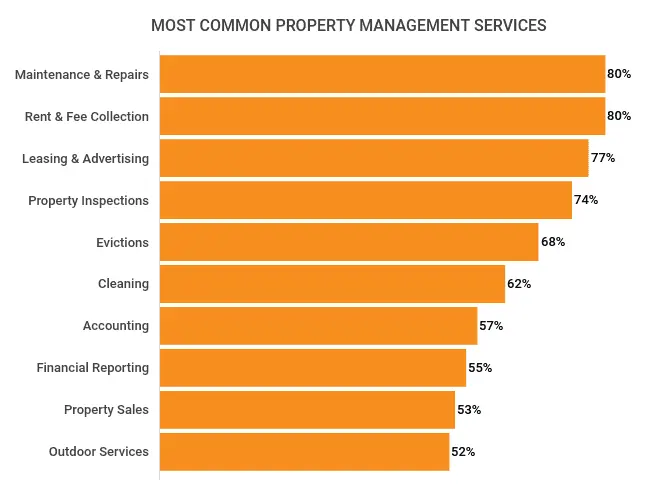

If you’re going to be paying a portion of your rental income to a company to manage your properties, be sure to ask them what kind of services the company offers.

Credit: iPropertyManagement

If they offer the bare minimum (collecting rent, maintenance, and leasing), then they’re may not the best option.

Mr. Maxim says a property manager’s reputation is everything. “Real estate is a word-of-mouth industry. Find someone that comes recommended. Someone that has managed properties in the past. You should look at this like a dating relationship. Make sure your values match. Make sure you have similar temperaments. This is a business partner representing your property. Don’t take it lightly.”

Do some research and look for reviews from existing tenants and previous ones. Facebook and Yelp are good places to start, but you can also look at the BBB and Chamber of Commerce to review complaints and positive reviews.

You want to make sure the company you hire is licensed to operate in your state. These licenses and certifications prove that they have the skills and qualifications to run a legitimate property management company.

Important credentials a property management company should include (but are not limited to):

Before you sign on the dotted line, be sure to thoroughly read through the property management agreement. This agreement will go over the services provided, a breakdown of the fees, owner responsibilities, contract duration, and stipulations if you want to terminate the contract early.

The property management company you ultimately sign with should have the right insurance converges. These insurances will cover their business, the tenants, the properties they manage, and yourself.

The property management company should have (at least):

Ask the property manager how they screen tenants. Do they do an in-depth application process that includes a criminal background check, credit report, and income/employment verification?

Business isn’t about deals. It’s about relationships and we’d love to begin one with you. Interested in buying a property? Have a question about our process? Curious about a local market? Let’s talk.

There are tools in every industry that makes the job a little easier, and property management is no different. In fact, property management software is one of the driving factors for the market’s continued growth.

Property management software simplifies many of the tasks associated with managing a rental property, such as:

Do you need to use property management software if you want to self-manage your investment properties? No, not at all. Ms. Melle sums it up the best:

“Although these programs can be useful tools, they are simply administrative and do not help the landlord understand the law, advise when tenants cannot pay the rent, represent you in a legal eviction, or be the boots on the ground needed during repairs, move outs, inspections, etc.”

With more than 300 property management software products on the market, it’s hard to know which program can suit your needs. Here are a few programs Mr. Capozzolo recommends:

Buildium is a comprehensive software that streamlines the entire property management process. There are a lot of features and can also work with external platforms like Zillow, Forte, and HotPads to name a few.

AppFolio is designed for investors who are working toward owning 100 rental properties or more, but it’s something to consider as your portfolio grows. If you plan on having a robust portfolio with a variety of property types, such as residential properties, commercial buildings, etc., this is a program to try.

MRI Software offers many advanced features and is very easy to use. Not only can you manage residential properties, but it can also manage the complex financial needs of commercial properties. If you’re looking for a reputable company to do business with, MRI was founded in 1971 and has had more than 52,000 clients in over 170 countries.

A: “This depends on the contract agreement and the conditions to which both parties agreed. If you are still dissatisfied with a company’s job, you may still have to pay the fees even if you break the contract. Hence, it is essential to get a lawyer to draft the agreement so that you are protected,” advises Mr. Capozzolo.

A: “In order to start a property management company, in most states it does require the owner to be a licensed real estate broker. You must understand how to operate a “trust” account and the legalities associated with that responsibility which are extremely specific and strict.”

“Many brokers avoid property management due to the stringent trust account procedures which require the accounts to be balanced three different ways every single day to avoid a violation which can result in loss of your license.”

“Most brokers lose their license due to trust account violations and the DRE does not discriminate based on dollar amount so whether the account is 1 cent off or 1 million dollars off balance, it is viewed the same. Many brokers do not want that type of pressure for the small dollar amount received per property,” says Ms. Melle.

A: There isn’t that much of a difference between managing a single family and a multi-family property. However, if you have a multi-family property with more than a certain number of rental units, you’ll need an on-site property manager.

In California, for example, the magic number is 16. It may be different for your state. So you’ll definitely need to check with your state’s laws to find your state’s requirements.

Before even beginning the eviction process, you must first have a valid reason to want to evict a tenant, such as not paying rent, violating the lease, or causing damage to the property.

Each state has its own eviction laws, that you’ll need to familiarize yourself with if you intend on self-managing your property.

The actual process will vary from state to state, but in every state, it is illegal to try to evict someone yourself. There’s a legal process you must follow:

Step 1: After establishing a valid reason for the eviction, you will need to complete a formal notice.

Step 2: The notice must be sent to the tenant via certified mail. Make sure the paperwork clearly states a date to comply with the notice or remedy the problem.

Step 3: If the tenant doesn’t comply by the deadline, the next step is to file for eviction at the courthouse.

Step 4: The tenant and yourself will attend a hearing in front of the judge. If you win the case, the judge will outline the terms of the eviction.

Step 5: If applicable, you can sue for damages or unpaid rent.

A: It may be tempting to set your rent on the high side, but if you do that, you run the risk of being too expensive for the market. The best way to set a fair market rent is to see what other landlords are charging for similar properties. You’ll want to look at the location, size of the property, type of property, features, number of bedrooms and bathrooms, etc.

When you’re working with a property manager, they will run a real estate CMA (comparative market analysis) and will give you a recommended price based on their findings.

A: While you don’t have to use the preferred contractors, it’s in your best interest to do so because they are licensed, insured, and have a good reputation for doing good work.

At least, they should if you’re working with a good property management company. Sometimes property managers will try new contractors in an effort to get the best prices for their clients and it doesn’t always work out.

Remember, cheaper doesn’t mean better.

A: If you’re going to self-manage your property, you need to respect your tenant’s privacy and know when you can and cannot enter the rental property, so it’s important to read up on your state’s landlord access laws.

Typically landlords are required to give their tenants at least 24 hours notice before entering the premises for non-emergency reasons. However, some state landlord access laws are vaguer and simply state a landlord can give “reasonable notice.”

In your contract, you can include a clause in the lease regarding entering the rental. Here’s an example from the legal library, Nolo, of what that clause may say:

“Landlord or Landlord’s agent will not enter Tenant’s home except to deal with an emergency; to make necessary or agreed repairs or improvements; to supply necessary or agreed services; or to show the unit to potential purchasers, tenants, or repair persons. Except in cases of emergency, Landlord will give Tenant at least 24 hours’ written notice of the date, time, and purpose of the intended entry.”

Managing your first investment property can be a little scary because there’s a lot on the line, both financially and legally. Being a landlord is more than just letting someone live on your property and collecting the rent. You have to make sure you’re abiding by state and federal laws. You have to make sure the property is safe to inhabit. You have to make sure you’re finding good tenants who have the means to pay on time.

There’s a lot that goes into being a landlord and sometimes it’s more than a person can handle — especially when you’re working a full-time job because it’s not easy living off rental income alone. That’s where hiring a property management company to manage your property comes in.

Believe it or not, hiring a property manager to maintain your rental property may be one of the best moves an investor can make because they know the ins and outs of the industry. They understand the laws that landlords must abide by. When the property is vacant, they know how to market the property so it’s filled quickly with quality tenants.

When there’s a problem, they have a network of contractors they can contact to have the repairs done in a timely manner and correctly. If you have a problem tenant, they can get the eviction process going so you don’t have to.

Property management companies can make your life as a landlord so much easier. Even though you’ll be charged management fees and will take a small portion of your rental income, it’s worth it just to have the peace of mind of knowing your property is in good hands.

All that said, if you’re still considering self-managing your property, for the time being, Ms. Melle shares some insight about owning an investment property and becoming a landlord:

“Treat the property like a business. This is a large asset worth hundreds of thousands of dollars and should be treated as such. The tenant is a customer and should be treated as such. This means that the property is your product and the tenant is your customer.”

“What type of product are you offering and do you have the ability to maintain it in a professional manner? A landlord’s personal finances should be at a level that they can maintain the property without an issue, upgrade it often, withstand and be prepared for periods of time where no revenue is coming in, and hire a professional rental property management company to manage.”

Business isn’t about deals. It’s about relationships and we’d love to begin one with you. Interested in buying a property? Have a question about our process? Curious about a local market? Let’s talk.