New Western is committed to delivering opportunities to aspiring investors and keeping them well-informed with timely and relevant content that follows strict editorial integrity.

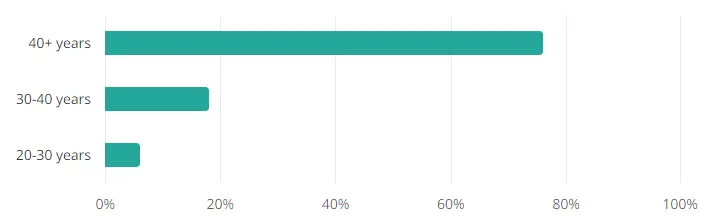

Credit: Zippia

Let’s take a look at some of the most common reasons people go into this industry.

It may sound odd, to be fascinated by real estate, but many people love the thrill they get when looking at properties and envisioning transforming them into something glorious.

People who have a passion for real estate can see a room, and know which upgrades will have the biggest impact and highest return on investment (ROI).

What’s more, people who are considering a career in real estate often have a passion for the industry and are excited to help people find the perfect home in which they can begin building a life for themselves and their families.

There are many different real estate career paths, some of which do not require a real estate license. However, If you do decide to become licensed, you can use that experience to further your career in property management, commercial real estate, and (of course) real estate investing.

Being a licensed agent expands your knowledge of the industry and allows you to participate in many different types of real estate transactions.

Some of the best real estate jobs have unlimited earning potential. It all depends on your ambition to sell as much real estate as you can by harnessing the skills needed to identify a client’s needs and show them the right properties. Working as an agent puts you in control of your earning potential and ultimately, your financial success.

Getting started in real estate is much easier than in other industries that require different types of certifications, and degrees licenses.

Generally speaking, you can become a licensed real estate agent in less than a year of studying, depending on where you’re taking your licensing exam.

Becoming licensed is also much more affordable than obtaining other degrees, licenses, and certifications and can be done almost entirely online in some states.

There’s more to real estate than residential and commercial properties. You can specialize in luxury, low-income housing, planned developments, industrial, and so on.

From a professional standpoint, we asked four real estate professionals to weigh in and share why they went into the industry:

"Oh my goodness there are so many reasons to want to get into real estate. There’s the flexibility (although don’t let that fool you, just because you can pick and choose when you want to do the work still means you have to do the work), the endless opportunity, the love of the industry in general, and of course the desire to help people achieve their homeownership goals."

"As for me personally, my story is like so many others, I just kind of fell into it if I am being honest. But also like many others, I grew to truly love this industry for all of those very reasons. I am a hard worker so I had no doubt I’d be able to put in the time and I needed something flexible for my schedule and for my life as I was moving around quite a bit at the time."

"I was afforded the opportunity to learn from some of the best and then apply what I learned along the way to my own business and ultimately to my career helping others now grow their business in real estate on purpose by coupling their profession with a bigger purpose to find their ultimate fulfillment and true potential."

- Ms. Abby Waltz, National Director, Homes for Heroes, licensed real estate agent and investor

"Perhaps the most common reason people enter real estate is that it has been both an enduring and thriving industry that has been around for hundreds of years. Real estate is not going anywhere. People live, work, and sleep in buildings and real estate is a career that everyone can relate to."

"I got started in real estate because I wanted the financial freedom to do work when I wanted to, be my own boss, and not have to report to work from nine to five. Most of all, I am passionate about transforming spaces and building lives within them to enhance our community."

- Mr. Ari Shpanya, CEO of the commercial real estate financing firm, Loan Base

"They think it’s easy money. I sell land, so I’m not doing residential real estate, which I think is the hardest career within the real estate industry. There are too many laws and regulations, you can get sued very easily."

"I got into it because I’m a land investor, and was offered the opportunity to join a well-established team within the premier land banking company in the US."

- Mr. Bradley K. Warren, Strategic Real Estate Advisor at Real Estate Bees

In this section, we are going to break down the different career paths that are related to the buying, renting, and selling process.

Note: All salary details are accurate at the time of writing this guide.

Required Education and Credentials: After completing a training course, candidates must demonstrate that they are qualified for a state license in real estate.

For those that want to get started in the industry as quickly as possible, residential real estate is a popular professional path you can get into relatively quickly.

To become a licensed real estate agent, you’ll need to complete a pre-licensing course at an accredited real estate licensing school. Once you have finished the required coursework, you can register, take and pass a state-administered exam. Unfortunately, the course only covers state/general laws and needs to expand on the skills required for being a successful agent.

Here are the general steps you will need to take to become a real estate agent:

Real estate agents are paid on commission. The listing agreement contains the commission that will be delivered to both the listing agent and the buyer’s agent, typically equal to three percent of the total sales price. Nevertheless, only some agents receive the full 3% commission. Their broker deducts a fee, which is often in the range of 25–50% of the total.

This can be difficult early in your career when you haven’t built a network. This is especially difficult in a traditional residential real estate agent role since the average American will only own three homes in their entire lifetime. A single investor could surpass this by investing in real estate in one year.

There are 3 main types of agents. In the following section, we will cover each.

This is a typical career path with very modest obstacles to enter, which is both a benefit and a burden for new real estate agents. Since this is a popular and relatively easy career path, there is an abundance of agents working in this sector, which requires you to put in added effort to stand out against the competition.

To do business lawfully, real estate agents are required to report their activities to a qualified real estate broker. In most cases, their broker is the one who instructs them on the necessary abilities for the job.

The median gross income of traditional agents—income earned from real estate activities—was $43,330 in 2020, a decrease from $49,700 in 2019. Agents with 16 years or more experience had a median gross income of $75,000—down from $86,500 in 2019—compared to agents with two years or less experience with a median gross income of $8,500—a decrease from $8,900 in 2019.

These agents find and sell properties with an opportunity for an investor to add value. The homes are generally not “move-in ready” and often don’t qualify for traditional financing. These agents have specialized market knowledge and are crucial when investors are looking for properties to use as rentals or to fix and flip.

It is best to partner with a top real estate investment brokerage like New Western to pursue this career path. We provide specialized tools and training to help Investment Real Estate Agents build a successful business.

It is often more lucrative, especially early in a career, to work with a brokerage that provides properties and investors so you can start earning right away. Working with New Western also allows you to hone your skills early by offering tools and training as part of your relationship.

Unlike traditional brokerages, we give you the houses to sell. Our team of hundreds of Acquisitions Agents purchase exclusive inventory by leveraging our ecosystem and scouring every market corner using our proprietary methods. Access to this exclusive inventory will allow you to start selling deals quickly, often within your first 30 days.

The inventory that we control, combined with professional buyers and fast closings, leads to quicker commission payments. Did we mention what those commission payments look like? New Western agents average $126,036 in annual commission, with top producers earning more than $500,000.

Check out our Glassdoor page for more info.

Learn more about this opportunity at our careers page.

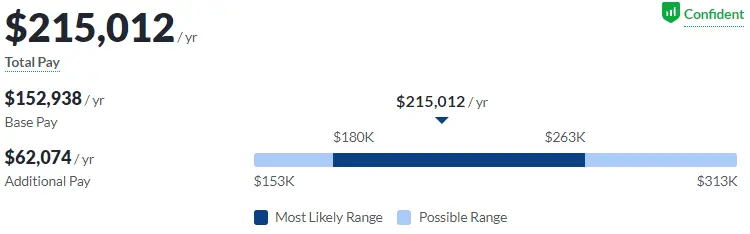

Although this involves connecting buyers and sellers, much as it does with residential buyers, commercial buyers have quite different requirements than residential buyers do. Not only do commercial real estate brokers need to be familiar with the characteristics of the local market but also with financial indicators such as cap rates and the internal rate of return (IRR).

They should also be aware of items special to the location, such as variations in zoning and the requirements for permits, as well as adjacent resources, such as parking and public transit.

In the same way that residential real estate agents show homes to prospective buyers, commercial agents also assist their clients in the negotiation process, draft legal contracts, and make sure that closings are on schedule. They also cooperate with other service providers, such as inspectors and appraisers, who are associated with the industry.

The agents that specialize in commercial real estate depend significantly on their network. Those who are the most successful have the widest local networks of connections possible in their respective fields of expertise.

“I believe the most challenging career in the real estate industry is commercial real estate. The industry is cut-throat and doesn’t need slackers. You must be efficient and at the top of your game.”

“I wouldn’t say that it is particularly stressful as all types of jobs carry their amount of stress. However, there is good money which makes it worth the while. If you’re looking for stability, commercial real estate is the right choice. About 43% of people in the real estate industry prefer commercial real estate over residential or other industries,” adds Mr. Capozzolo.

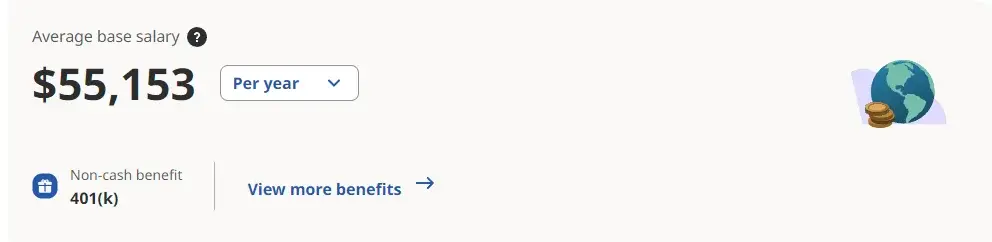

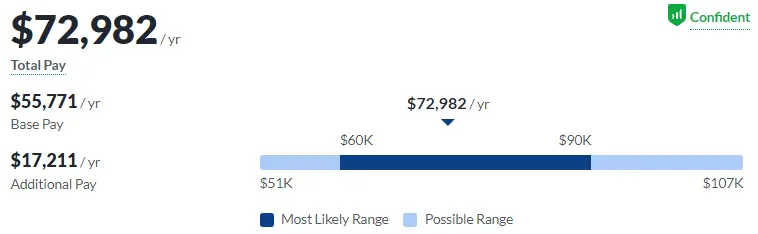

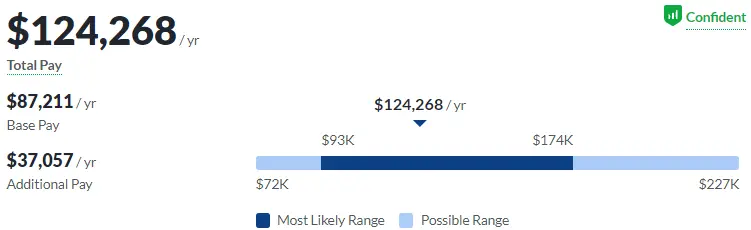

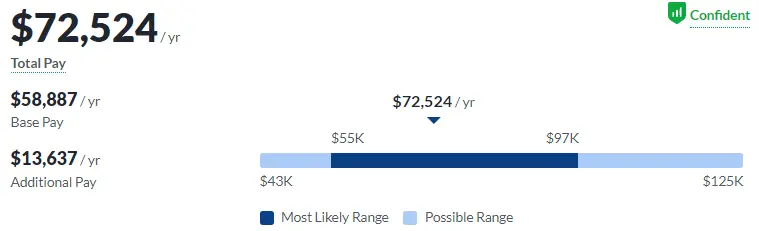

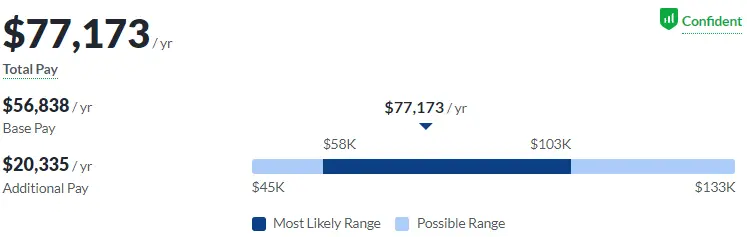

Credit: Indeed

If a real estate agent wants to take their career to the next level, they could get their broker’s license by taking extra classes and meeting the requirements.

Brokers establish their very own real estate brokerages, complete with their very own licenses, and staff those brokerages with real estate agents to assist buyers and sellers. They get a cut of the commissions that are earned by each of their agents.

Along with allowing agents to operate under their license, brokers also supply agents with one-on-one training, private offices, leads, etc. Becoming a real estate broker is the first step to establishing your own successful real estate company.

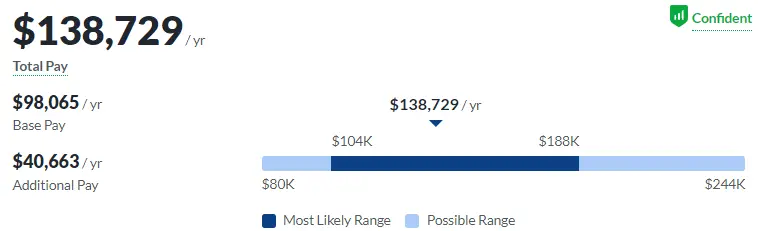

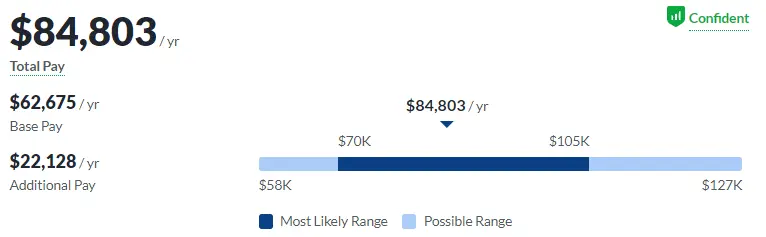

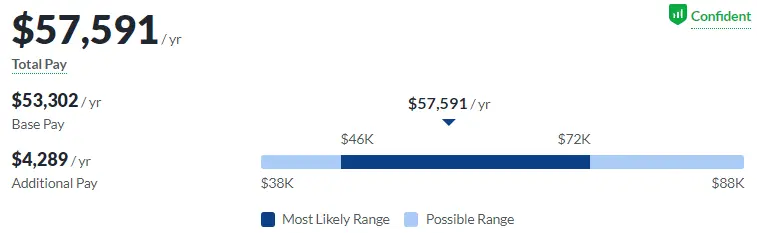

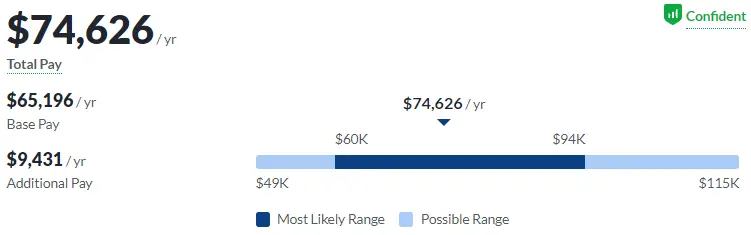

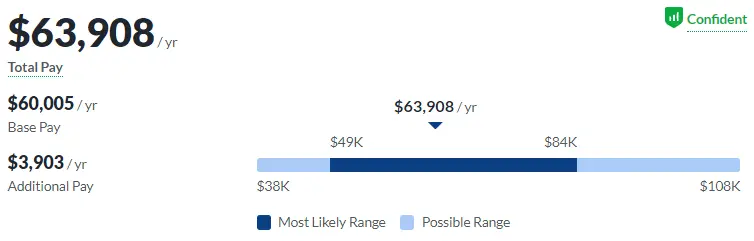

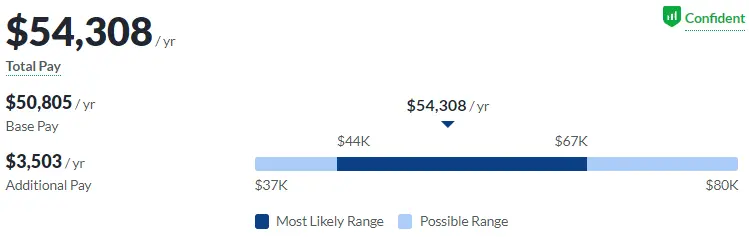

Credit: Glassdoor

There are three primary levels, or tiers, of real estate brokers, each with a different amount of responsibility:

1. Associate brokers are licensed brokers who make the decision to operate under the supervision of another broker. In most cases, associate brokers are not responsible for the supervision of other real estate agents.

2. Managing brokers are responsible for overseeing transactions as well as the day-to-day operations of the firm.

In addition to this, they are responsible for the actions of their agents during a real estate transaction, hiring new real estate agents, providing them with training, and supervising administrative staff.

3. Principal/Designated brokers provide oversight to their agents to ensure that they comply with state and federal regulations governing the real estate industry. One broker is selected to work in each of the real estate offices.

Required Education and Credentials: To become a licensed broker in certain states, you must complete extra training and pass additional examinations. Before becoming eligible to become a broker in many jurisdictions, prospective candidates must first meet the requirements to get licensed as real estate agents for some time (each state may have different requirements in that regard.)

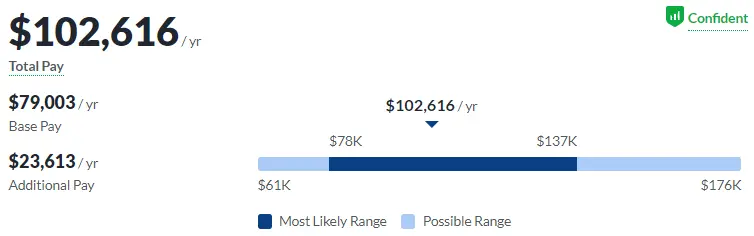

As with any other kind of company, real estate brokerages need administrative help from office administrative staff in order to function properly.

These employees are responsible for answering phones, scheduling showings and other appointments, managing schedules, and doing a variety of other clerical tasks.

They aren’t allowed to show properties or discuss property prices because they are not licensed. However, they do provide supportive services to real estate agents so the agents can focus more of their time on helping clients (and earning money) instead of doing the paperwork.

It’s certainly not the most exciting job in the world, but working at a real estate brokerage as an administrative assistant is an excellent way to get your foot in the door if you’re interested in pursuing a career as a real estate agent or anything connected to the industry.

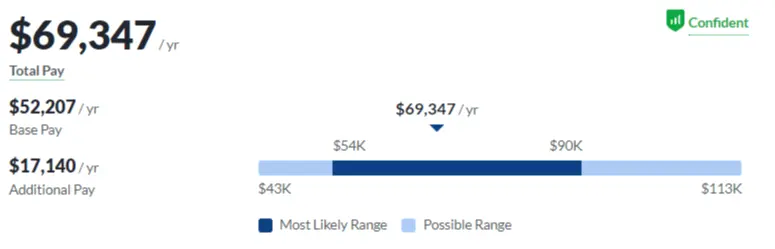

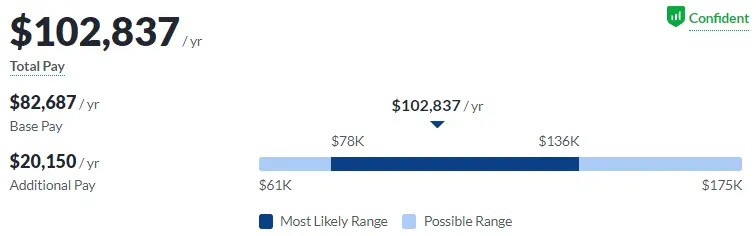

Credit: Glassdoor

Required Education and Credentials: There aren’t any specific courses or licenses that you need to become a real estate administrative assistant, but having prior office experience is a plus.

The goal of real estate brokerages, just like that of any other kind of company, is to connect with the largest number of potential customers.

To expand their customer base and improve their overall brand image, they hire marketing professionals. The objective is straightforward: increase the amount of business that the agents do, both with buyers and sellers.

Advertising for real estate businesses may take the form of:

Consider pursuing a job that combines marketing with real estate if these are two areas that interest you.

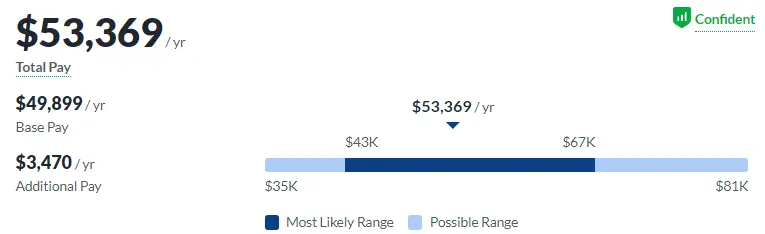

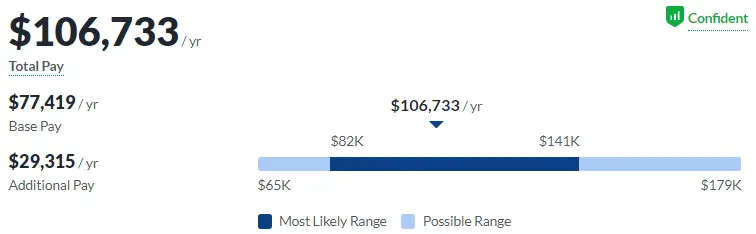

Credit: Glassdoor

Required Education and Credentials: Although a particular license or degree is not required for the role, the more experience you have in marketing, the higher your chances are of being successful in the role.

Leasing agents, in contrast to real estate agents, are mainly concerned with finding tenants for vacant houses rather than buying and selling homes.

If a brokerage doubles as a property management firm, a leasing agent may be hired to take potential tenants on tours of available units, vetting applications, preparing and signing leases.

This is a people-oriented position where a huge chunk of time is devoted to showing unoccupied homes to those interested in renting them. Leasing agents often focus exclusively on either residential or commercial properties as their area of expertise.

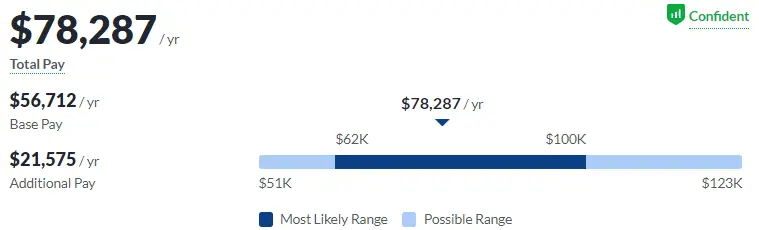

Credit: Glassdoor

Required Education and Credentials: Although a lot of states do not require that leasing agents hold a license, many of them are licensed, real estate agents.

Property managers take on the tasks of leasing agents, but their work does not end with signing the lease.

Property managers are employed by landlords to take on the laborious tasks of filling unoccupied properties, screening tenants, signing lease agreements, collecting rent payments and other fees, and enforcing the terms of the lease on the landlord’s behalf.

Property managers are also responsible for overseeing repairs and upkeep on the properties they manage, and they communicate directly with (licensed and insured) contractors and handymen. Usually, property managers are also in charge of maintaining financial accounts and generating financial statements.

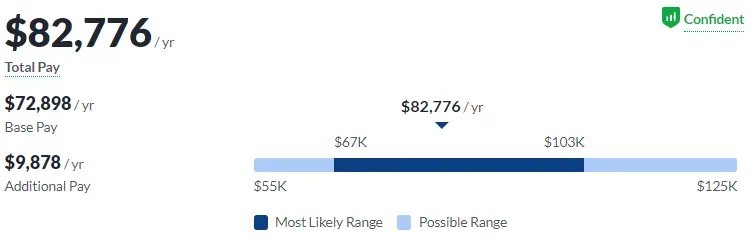

Credit: Glassdoor

Required Education and Credentials: Property managers often focus on either residential properties or commercial real estate as their primary area of expertise and then they’ll niche down and specialize in a specific area of the market. Depending on your state, a real estate license may or may not be required.

Home staging is the perfect combination of interior decorating and real estate marketing. Stagers are responsible for furnishing and decorating houses in order to showcase them in the most favorable light by making it easier to sell.

Staging an empty house is no problem for them because they usually have access to a wide variety of furniture and accessories to suit any home’s style.

The National Association of Realtors (NAR) surveyed a panel of real estate professionals and discovered that 82% of buyers’ agents said that staging makes it easier for potential buyers to imagine a property as their future home. Many agents feel that home staging increases the home’s value and reduces the time it spends on the market.

Credit: Glassdoor

Required Education and Credentials: Although you don’t need a license in real estate to be a home stager, it’s a good idea to have some experience in interior design.

When it comes to photography, some photographers choose to focus on real estate instead of wedding ceremonies or portraits. However, the intention is still the same: to make the subject’s photographs stunning.

Stagers and photographers often come together to make the house look as appealing as possible in photos. Some staging companies will provide services where they will temporarily stage a house, take pictures for the listing agent, and then quickly remove their furniture pieces and other décor items so that they can use them at another property.

Photographers who specialize in real estate typically have their own lighting gear that they’ll use for the job. They’ll also use professional cameras, special lenses, tripods, flash, and so on.

When potential buyers see the photos, they’re usually in awe because the properties appeal bigger, well-lit, and more appealing than it really is. This can be accomplished by ensuring that the lighting, the décor, and the camera angles are all perfect.

A great number of real estate photographers in today’s world are also experienced drone pilots who will take aerial footage. These pictures and videos can make listings stand out even more than they already do.

When we talk about videos, we should mention that some photographers also offer video tours, 3D mapping, and other types of virtual tours to help potential buyers with getting a better idea of what their property is like before going there.

Photographers that specialize in real estate usually operate as independent contractors who work for themselves. Real estate photography is often something that is done by photographers on the side or as part of a bigger photographic company.

Credit: Glassdoor

Required Education and Credentials: Real estate photographers may not need professional qualifications or higher education to work in the field; rather, they just need experience, the right gear, and a keen eye for taking flawless photos of properties.

Find your purpose. Create a long-term career path. Help your community. It’s what New Western warriors do every day. Join our team and help us continue to disrupt the real estate industry.

Some folks may choose to make financial investments so they can buy properties themselves instead of working in the real estate sector as service providers.

However, there are many other ways real estate investing can help you make money. Take a look at the many investment strategies listed below before choosing which one you’ll focus on.

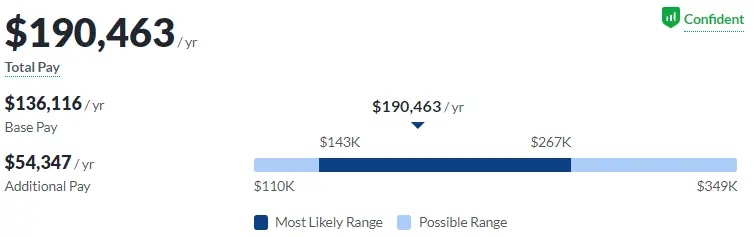

A real estate investor is someone who makes financial investments in real estate. With the goal of making a profit, investors buy and sell real estate, adjust the prices at which they are sold, collect rent, and influence local government officials and bodies that regulate land usage.

Investors have the option of working alone, with a business partner, or as a member of a larger network of investors, often referred to as REIGs (real estate investing groups); and if an investor has enough knowledge and expertise, they may be hired to oversee investment portfolios for businesses or other investors.

Alternatively, investors can be hired to help seek out new real estate investment opportunities. These jobs may fall under the category of “property portfolio management” or “property investment advice.” The rapid increase in the value of land should be your top worry.

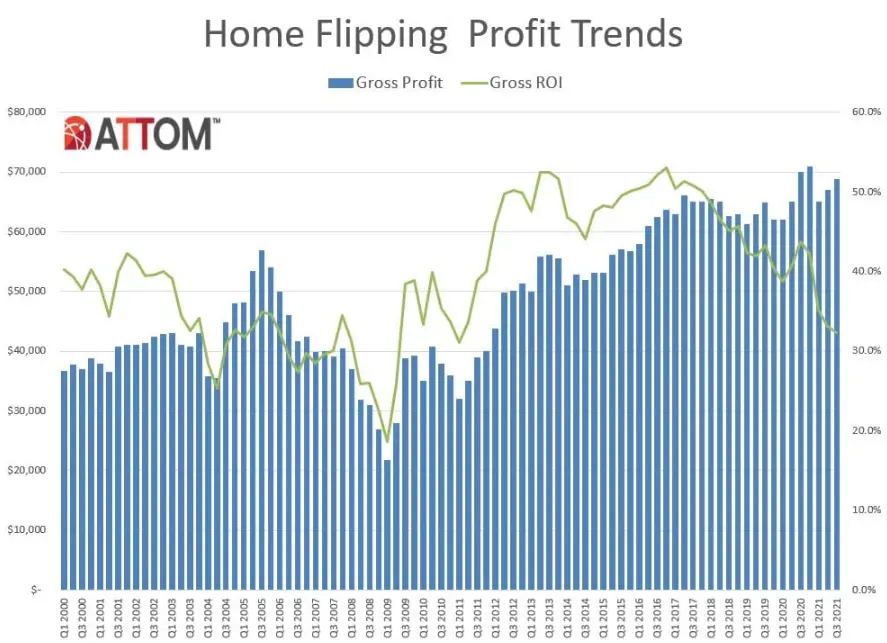

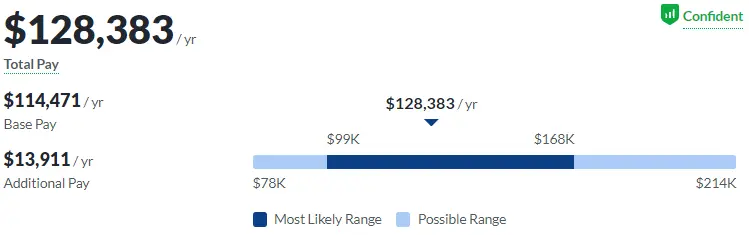

Credit: Glassdoor

Required Education and Credentials: To become a real estate investor, you don’t need any specific educational credentials. You do, however, need to have a solid understanding of the real estate market and enough capital to make a down payment on a said investment property.

When it comes to real estate investments, there are many different submarkets you could specialize in. You have your pick of markets to enter, from land speculation to the operation of self-storage facilities, from investing in mobile homes to the management of whole mobile home parks.

Some investments demand a modest upfront investment; for example, you can buy a cheap plot of land in Wyoming for as low as $1,558. If you wanted to buy and manage a mobile home park, you could cost between 6- to 8-digit figures!

However, one thing that a good number of these niches have in common is a lower amount of competition in comparison to more traditional investment techniques such as purchasing rental homes or flipping properties. And since there’s less competition, you can expect more profits.

Everybody is familiar with the concept of being a landlord — you buy a property and rent it to qualified tenants.

A common misconception from those who want to become a landlord is that they think it’s an easy way to make money. However, it’s not that easy.

Being a landlord requires more work than you’d think, especially if you’re a self-managed landlord (you do not have a property manager/management firm handling your rentals).

As a landlord, you are tasked with advertising your rental property, screening potential tenants, drawing up and signing leases, collecting rent, keeping up with maintenance calls, and enforcing the terms of the lease.

Many landlords, especially those in big cities, struggle to navigate the ever-changing regulations imposed on landlords.

Credit: Glassdoor

Required Education and Credentials: Although landlords aren’t required to have any education or special licensing, new landlords can expect to make some mistakes along the way.

Thankfully there are many resources you can turn to for advice, such as real estate investing forums and real estate investor Facebook groups, as well as the experts at New Western.

If you’re interested in short-term rentals, which have become one of the more popular real estate strategies, you’ll be faced with a different step of challenges.

Instead of focusing solely on landlord/tenant laws and tracking down tenants for late rent, hosts (those who own the short-term rental) have to deal with fast turnovers, high vacancy rates, and paying the bills on both their primary residence and the short-term rental.

On top of all of that, you have to be mindful of local laws regarding short-term rentals. Some areas have heavy regulations on this type of investment property, whereas other areas have strictly forbidden them. Plus, while it may be legal today, local governments could change legislation to the contrary.

Keep in mind that hosting websites like Airbnb and VRBO will also withhold a modest percentage of the nightly charge, further eating up your profits.

Host Fees Charged by Popular Short-Term Rental Platforms

Unlike investing in existing real estate, developers can buy a huge swath of raw land, improve it by connecting it to the city water and sewer lines, or split the land up into smaller plots and sell the lots to individual clients who wish to build a custom home.

Another option is to build up the lots and turn the land into a community and sell the finished residential properties to individual homebuyers.

Having a degree and experience in urban planning or civil engineering can give you a competitive edge in the real estate development industry.

However, the best way to get ahead is to simply gain work closely with a real estate developer so you can understand how the process will work, the usual obstacles, and how to minimize threats.

If you’re going to be a real estate developer, you should expect a bunch of hurdles, like obtaining permits and inspections, on top of the usual challenges you can face when working with contractors.

Credit: Glassdoor

Required Education and Credentials: None are required, but civil engineering and urban planning degrees and experience are a big plus. Also, real estate developers will need a substantial amount of capital to get started on this career path.

At the height of the real estate bubble during the mid-2000s, flipping houses grew in popularity and it hasn’t slowed since. Investors will look for distressed homes for sale, buy one, renovate and repair it, and then resell it for a quick profit.

Flipping houses isn’t easy. Flippers have to find distressed property leads and then usually submit bids on those properties. You need to have a knack for spotting a good deal and then communicating effectively with contractors, vendors, and service technicians.

It’s beneficial (not necessary) for flippers to be comfortable doing manual work so that they can take on some of the renovation projects, which will help with their bottom line.

Flippers must also stay up-to-date with the local regulations for building permits, building codes, and required inspections. If you don’t get permits, are not up to code, or fail the inspections, you may face costly fines, penalties, or in the worst-case scenario, demolish the process you’ve made.

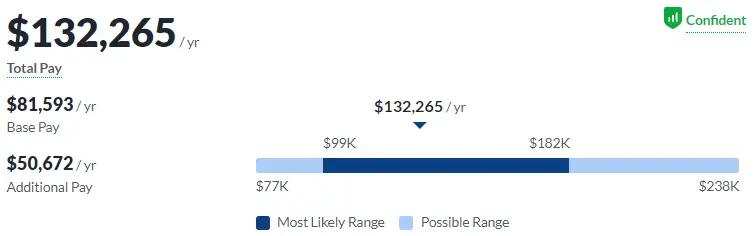

Credit: ATTOM Data

Required Education and Credentials: You don’t have to have any special degrees or credentials to be successful. However, you have to have a robust network of licensed and insured contractors and a solid plan for finding the best distressed houses to flip.

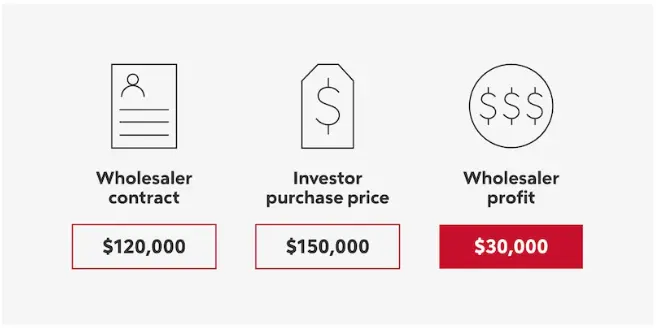

There are those who trade contracts for real estate instead of the actual properties, and they’re called “real estate wholesalers.”

The first step in this process is to find houses for sale (they may be foreclosed properties or distressed properties) and then put an offer on them.

After putting in an offer, wholesalers will then reach out to their network of house flippers or private investors to see who might want to purchase the property.

In order to do this, wholesalers must know how to read the market and how to do real estate CMAs (comparative market analysis) to find properties that match their criteria.

They must also know how to adjust the price so that they can offer it to their network at a below-market value while still netting them a profit.

For example, a wholesaler bids $75,000 on a property that’s worth $100,000. They then turn around and offer it to their network for $85,000. The investor only pays $85,000 for a $100,000 property and the wholesaler walks away with a $10,000 profit.

The success of this strategic plan depends on your ability to find distressed properties and have a robust network of real estate investors. If you have a large pool of investors who will buy your contracts, there’s a lot of money to be made. However, if your network is small or you’re unable to find great deals, you might not be as successful.

Credit: Rocket Mortgage

Required Education and Credentials: There aren’t any degrees or special credentials required in order to become a real estate wholesaler. However, you do need to know how to spot great deals, how to read the market and have a large enough network of investors with whom you can resell the contracts to.

Find your purpose. Create a long-term career path. Help your community. It’s what New Western warriors do every day. Join our team and help us continue to disrupt the real estate industry.

In 2021, 24% of US homes were bought by real estate investors, and we all know how expensive buying real estate can be. While investors have a CPA to give them advice regarding how many mortgages they can have or how to maximize a $40k cash flow, there are many career paths within the lending world for those who are interested in starting their real estate career.

Loan officers provide potential borrowers (homebuyers, investors, and even corporations) with advice, recommendations, and authorization for granting mortgages.

They verify the information supplied by the applicant to ensure they meet the income and credit requirements set forth by the lending institution.

Loan officers also work to find the best loan that meets the needs of the client, while ensuring the terms of the loan complies with state and federal lending regulations.

Credit: Glassdoor

Required Education and Credentials: Mortgage loan officers are required to obtain a Mortgage Loan Originators (MLO) license. They’re required to have at least 20 hours of coursework completed and pass the MLO test.

They are also required to agree to have their background and credit history scrutinized before they finally become licensed. Despite needing to renew the license every year, it’s unlikely that your history would be scrutinized each year. But be aware that some states may have additional requirements.

Mortgage processors are responsible for organizing and cleaning up loan files in preparation for assessment by the underwriter. It is their job to make sure the files have the required paperwork necessary for the loan.

Underwriters then examine loans with a proverbial fine-tooth comb, searching for any risk indicators that demand further investigation. In most cases, an underwriter will return a file back to the loan officer who is working on that file with a request for additional information and documents.

Many mortgage lenders don’t keep loans on their books, they’ll sell the loans to corporations like Fannie Mae or Freddie Mac.

In doing this, lenders free up more money that can then be used to issue new loans and collect more fees. Underwriters are responsible for making sure that lenders are able to sell the loans they originate and aren’t stuck with them because no one will buy them.

Credit: Glassdoor

Required Education and Credentials: Much like loan officers, underwriters and processors must take the NMLS exam to become licensed. Then it’s just a matter of securing a position in a lending institution to gain experience.

The role of the mortgage broker is to serve as a go-between for borrowers and lenders. They do this in order to collect money and points with every loan that they successfully close on, which is why it’s crucial for them to match the right lenders to the right borrowers.

Brokers typically launch marketing initiatives that will allow them to nurture leads with the hopes of converting said leads into closed loans. Mortgage brokers can rake in huge profits, but the amount of responsibility they’re undertaking is just as enormous.

Credit: Glassdoor

Required Education and Credentials: On top of needing to take the NMLS exam, brokers are required to hold bonds and fulfill minimum net worth guidelines outlined by each state. Additionally, in order for them to be successful, they need to have a solid marketing plan for generating leads and a large network of lenders and personnel who can close on the loans.

Real estate investors may get short-term loans from hard money lenders so they can buy and renovate properties. These lenders often charge higher interest rates and origination fees, thus creating high-risk loans that borrowers are likely to default on.

In order to mitigate this risk, hard money lenders usually provide 70% to 80% of the value of the property in question.

Although it is possible that hard money lenders could use their own funds to issue loans, many hard money lenders will seek funding from a third party. This could be their friends, family members, co-workers, or even other investors who just want to increase their profits.

That said, if a borrower defaults on their loan, hard money lenders still have to go through the foreclosure process. Unfortunately, real estate investors aren’t afforded the same protections as homeowners. That means the process could be completed much more quickly and cost hard money lenders less.

Credit: Glassdoor

Required Education and Credentials: Those interested in becoming a hard money lender aren’t required to have any credentials or licenses like the previous lending professionals we discussed. They should, however, have a very comprehensive understanding of real estate financing and the real estate industry as a whole.

During the process of reviewing a mortgage application, a loan officer would often turn to a real estate analyst for insight because they’ll use both the current state of the real estate market and the overall economic climate when determining whether or not a particular project will be lucrative.

The analyst would then be responsible for a significant portion of the background work that’s involved in the execution of a loan which includes (but isn’t limited to):

They can work in a variety of professional environments and operate in a wide variety of settings, supplying their employers with the knowledge necessary to make informed judgments on successful methods of finance and investing.

Credit: Glassdoor

Required Education and Credentials: At the bare minimum, financial analysts are required to have a Bachelor’s degree in either accounting, finance, or real estate, however, some employers look for candidates with a Master’s degree in business administration. There are a couple of certifications that can help analyst progress in their career, such as Chartered Financial Analyst and Project Management Professional.

Escrow officers are neutral third parties who help to ensure all parties who are participating in the transaction have done everything correctly in accordance with state and federal laws. They are responsible for monitoring contracts to make sure the terms of the contract are upheld.

They are the ones who often manage the earnest money deposit, which serves as a pledge from the buyer to the seller. They will order the title as well as any other papers that pertain to the property, alert the parties involved if there is an issue with the title, and do a number of other tasks.

Sometimes escrow officers will work with mortgage lenders, but some will work with real estate attorneys, title insurance firms, or other independent escrow companies.

It is possible for escrow officers to find work with a lender, a real estate attorney, a title insurance firm, or another lender’s affiliated or independent escrow company. They cannot work for the buyer or the real estate firms who are participating in the deal.

Credit: Glassdoor

Required Education and Credentials: Although it’s not mandatory, there are some employers who prefer their escrow offers have a Bachelor’s degree in real estate or another related field. However, it is possible to become an officer with on-the-job training if you enroll in some escrow-focused coursework.

Find your purpose. Create a long-term career path. Help your community. It’s what New Western warriors do every day. Join our team and help us continue to disrupt the real estate industry.

Homebuyers and real estate investors alike understand how important it is to not skip the due diligence period, which can take anywhere from 10 days for residential properties and up to 60 days for commercial properties. Here are some careers that focus on due diligence and the legal side of real estate.

As of 2021, approximately 21% of appraisers work independently, but the majority work for a local government agency. They specialize in either residential or commercial real estate, much like real estate agents or brokers.

In order to arrive at an estimate of the property’s current market worth, appraisers will do a physical inspection of the property and examine comparable sales in the area.

They’re looking at the property’s amenities like the number of bedrooms and bathrooms, the square footage, and the floor plan. They also look at public land records, market sales data, and tax records to determine the property’s fair market value.

Mortgage lenders require an appraisal because they want to verify the property is worth the asking price. After all, they don’t want to lend more money than they have to because there’s the risk of the borrower defaulting.

Credit: Glassdoor

Required Education and Credentials: Appraisers often begin their careers as trainees or apprentices — higher education or experience isn’t required. They must have 75 hours of basic appraisal education and work with an experienced appraiser for supervised training before they can that the National Uniform Licensing and Certification Exam to become licensed. You can upgrade your license to become a Licensed Appraiser, Certified Residential Appraiser, and Certified General Appraiser.

A home inspector will look at the structure of buildings on the property to gauge its overall condition, while real estate appraisers evaluate properties to establish their worth. The average inspection takes around two to three hours to complete, but larger properties may take longer.

While they’re inspecting the property, they’re looking to make sure the building is structurally sound, there are no cracks in the foundation, the systems (HVAC, plumbing, electrical, etc.) are working properly, and so on. They also look at the roof to make sure it’s in good repair, there are no leaks or signs of water damage.

The goal of the inspector is to ensure the property is safe, inhabitable, and up to local code standards. They work for the buyer, but a seller can order a pre-listing inspection in order to make sure that the sale goes through without a hitch.

Credit: Glassdoor

Required Education and Credentials: Each state has its own requirements for becoming a home inspector, so it’s crucial that you are familiar with your state’s regulations. Next, you’ll need to complete a home inspector training program, be it an in-person course or an online course. Depending on where you are, you may have to take the National Home Inspector Examination (NHIE)

Rather than looking at the actual property, title officers concentrate on investigating the history of who owned the property and legal details like if there are any liens placed on the property.

Other tasks a title officer is responsible for include: confirming the property’s legal description, where the property lines are, and any outstanding debts. The title officer also checks to make sure the seller is the legitimate owner and can legally sell the property.

Title officers meticulously comb through these details so that they can grant title insurance policies to a mortgage lender, which is required for closing the real estate transaction. Also, the title company (thus the title officer) is typically responsible for drawing the closing disclosures and conducting the actual settlement.

Credit: Glassdoor

Required Education and Credentials: 46% of title officers have a Bachelor’s degree but it isn’t necessarily a must-have. Some states do require candidates completes some kind of coursework and they may even provide materials to help them prepare. You can learn more about your state’s licensing requirements on the National Insurance Producer Registry website.

When a real estate transaction is taking place, the buyer or the seller can hire a real estate lawyer to make sure the process is above board and follows local, state, and federal laws.

These attorneys specialize in real estate and are well-versed in the regulations that govern all aspects of purchasing, selling, and leasing residential or commercial property. Some states require a real estate attorney to be at the closing, while others do not.

The responsibilities of real estate attorneys go beyond making sure that real estate transactions go off without a hitch. They can work as intermediaries for tenants or landlords if there are any disputes that require legal intervention.

Credit: Glassdoor

Required Education and Credentials: To become a real estate attorney, you have to get a Bachelor’s degree, take the Law School Admission Test (LSAT), attend law school, and then pass their state’s bar exam. After becoming a bona fide attorney, you’ll need to gain experience working in a law firm or a title company as an entry-level attorney and stay up to date with new legal regulations regarding the real estate industry by attending conferences and seminars.

When you work as a real estate paralegal, you’ll work closely with attorneys by preparing, reviewing, and verifying legal documents necessary to close a real estate deal. These documents can include (but are not limited to): leases and subleases, purchase agreements, mortgage contracts, title affidavits, and property descriptions.

Paralegals are often tasked with answering any questions a client may have, attending meetings, and researching public records for details regarding a property.

Essentially, you’re a real estate attorney’s, right-hand man. Where you’ll work can be with banks, corporations, private law firms, real estate brokerages, or title companies.

Credit: Glassdoor

Required Education and Credentials: Becoming a real estate paralegal means you first need to have ABA-Accredited Paralegal certification or degree. Then you’ll need to take a course in real estate law, contract and property law, mediation and dispute resolution practices, and preparing legal documents. Finally, you’ll want to land an internship with a real estate brokerage to gain hands-on experience with the real estate industry.

A real estate professional that specializes in the foreclosure process is known as a “foreclosure specialist.” They are responsible for ensuring any settlement dealing with a foreclosure complies with the laws of the local, state, and federal governments.

Their duties span everything, from helping financially distressed homeowners to renegotiate the terms of their mortgages to advising investors about how to sell foreclosed properties.

These specialists are responsible for ensuring that the foreclosure process meets the deadlines. They will work with vendors, attorneys, and the right authorities to keep things on the up and up. They also work with borrowers who are at risk of going into default by making modifications to the terms of the mortgage agreement so they can avoid foreclosure.

Credit: Glassdoor

Required Education and Credentials: Although you don’t need a special degree or certificate to become a foreclosure specialist, there are some companies that require at least an Associate’s degree in legal studies, finance, or a real estate-related field.

There are so many different career paths in the real estate industry, it’s understandable if you don’t know where to even start! Our professionals have some advice for you:

Ms. Waltz: “If you find that it’s an industry that you love and enjoy and could be a career you’d be passionate about, no matter what path you take to find that out, it’s the one that was meant for you to find your purpose and passion.”

“When you do though, seize the opportunity, get licensed and do what’s right for you. Whether that’s joining a team, going it alone as a solo agent, or starting out as an investor or flipper, that’s ultimately what fits you best at that time. Just commit to yourself and your own success that you’ll give it your all.”

Mr. Shpanya: “The best way to get started in real estate is to find a mentor who does exactly what you would like to do one day and learn from them. Identify who that person is, contact them, and listen to what steps they took to get to where they are in their own career.”

“You can find a mentor easily by searching for investors that went to your high school or college, family members who are invested in real estate, or your friends’ parents who invested in real estate. Additionally, you can join local online groups on Facebook and Twitter and learn about how other investors got started.”

Mr. Warren: “Know ahead of time which company you want to work with, and meet the broker and find out what kind of support you can expect from him/her as well as the other agents in the office. Some companies are more collaborative (such as Keller Williams and eXp) than others, and smaller firms are generally more collaborative as well.”

Mr. Capozzolo: “In my opinion, there are two preferred ways. The first one is to get a college degree related to real estate, understand the business from within, and then apply for a job in companies.”

“The second way is to get your real estate license, work as a realtor at a brokerage firm or start your own business. I’d personally recommend the first option as it opens up versatile job opportunities and offers career progression all over the world. With a license, you’re limited to a particular state.”

The career path you choose should be one in which you can see yourself doing it in the long term — or at least until you’re ready to branch off into something new. If you are more interested in focusing your career on real estate investing instead of other real estate careers, then reach out to our team and learn how you can become a New Western Warrior.

Find your purpose. Create a long-term career path. Help your community. It’s what New Western warriors do every day. Join our team and help us continue to disrupt the real estate industry.