At New Western, our vision is a world where every real estate transaction is simple, certain, and satisfying. Therefore, we promote strict editorial integrity in each of our posts.

Whether you’ve saved, inherited, or won it, $30,000 is a significant sum. In fact, most Americans would call that amount of money “life-changing”, according to a poll commissioned by Self Lender.

If $30,000 truly has the power to change your life, the question becomes: How can you make that happen? A new car or a world cruise might both have a 30K price tag, but one-time spending doesn’t exactly fit into the category of “life-changing”.

To really change your life, you’ll need to focus on making $30,000 into a much larger sum, one that could truly make an impact on your quality of life for years to come.

By exploring investment options and looking at time-tested growth data, we’ll help answer the question of what to do with 30K –– and the answer might just change your life.

All right, slow down. Before we discuss strategies to build long-term wealth with $30,000, we’ll need to cover the basics of present financial security. Thinking about the future is great, but not at the expense of today’s wellbeing.

High-interest debt, such as credit card debt or short-term loans, should be the number one priority when considering what to do with 30K.

Credit card interest rates can soar well over 17%; short-term loans can rack up interest rates upwards of 13%. Those fees are well above what average investment plans can yield, which means that your debt losses would outweigh your savings gains.

That said, not all debt is created equal. Mortgages and other long-term loans (including student loans) may only charge 3%-5% in interest, a figure that good investments can definitely beat.

The point here is to zero in –– quite literally –– on high-interest debt. It’s impossible to get ahead with high-interest debt eating up investment profits.

Before thinking about long-term, life-changing investments, you need to ensure that any short-term emergencies could be managed from a financial point of view. Why?

Because the investment strategies that bring in the highest gains often have the least liquidity. In the event of a crisis, such as an illness, accident, or job loss, you need funds to be immediately accessible. But many long-term investments tie up your money for, well, a long time.

To best prepare for emergencies, keep three to six months worth of your current expenses in a high-yield savings account.

Yes, the interest gains will be relatively low, usually around 1%-2%. But you’ll avoid dipping into long-term investments (which can sometimes bring a penalty) or using credit cards to pay for emergencies.

Assuming those basics are squared away, you hopefully will have the bulk of $30,000 to invest. Before looking into all the options, let’s consider some factors that could inform the next steps in choosing what to do with 30K.

The stage of life influences the overall goals of every investor. People in their twenties may be more oriented toward saving for a downpayment, whereas people in their forties might be looking at funding their children’s education.

Self-employed individuals might have to focus more on retirement goals, whereas employees with a good 401K plan may have more freedom to explore non-traditional options.

Assessing your stage of life means taking a hard look at where you are now, projecting where you plan to be in the decades to come, and forming goals that incorporate the complete scope.

Your life stage circumstances help to form your risk tolerance. Risk tolerance refers to your lifestyle impact in the event of a complete loss. Say your $30,000 sum was lost overnight.

Would it affect your current way of life? If so, you have lower risk tolerance. But if you have a secure income and decent savings in place, then you can operate with a higher risk tolerance when looking to invest that $30,000.

Both stage of life and risk tolerance determines how aggressive you can be with your investment strategy. Older individuals with established retirement accounts may be able to put a whole $30,000 sum into a risky startup venture.

They can afford to be aggressive with their 30K. Younger individuals may choose to diversify more because their goals are split between a downpayment and retirement savings. They don’t have the luxury of financial security yet, so they can’t be as aggressive with their 30K investment.

With life circumstances, risk tolerance, and financial aggression in mind, you can make a better decision about what to do with $30,000. Consider the pros and cons of these options.

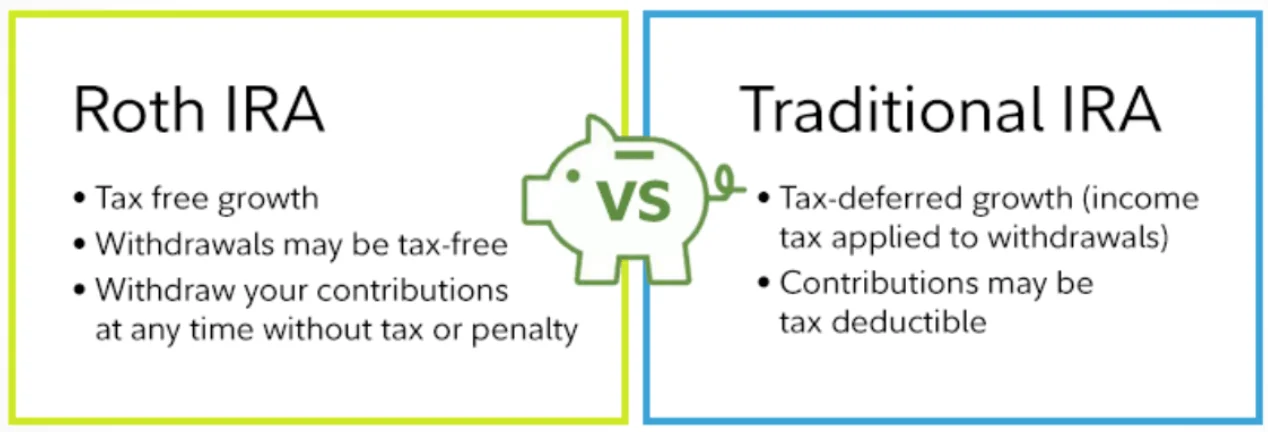

Aside from 401K accounts, which are available through employers, there are two main types of retirement accounts.

Source: Fidelity Investments

IRAs are low risk, and saving for retirement is a good idea at any stage of life. In fact, the earlier the better, thanks to compound interest. Below, we’ll look at the effects of compound interest over time.

Both types of IRAs have a $6000 maximum yearly contribution. That means, with $30,000, you could fully fund your IRA account for the year and still have money left over for other investments.

There are several types of government-backed investments available, depending on an investor’s goals and needs.

Stock market investments carry a range of risks and varying returns.

To further diversify your $30,000, you may also want to consider these non-traditional investments.

Investing in real estate can involve a couple of different strategies, each with its own merits.

Real estate investments are considered a valuable part of an investment portfolio for the following reasons:

Thirty thousand dollars is not enough to purchase a property outright, but in some markets, it is enough for a downpayment on a mortgage. With a good real estate investment, cash flow from rental income should exceed any mortgage loans taken on the property, so “good debt” is used as leverage to gain income, appreciation, and equity.

Real estate investing is also an excellent way to build and multiply generational wealth, due to the tangible asset that can be passed on as an inheritance. Not only can real estate impact your life now, but it can also impact the lives of your children and grandchildren.

By developing and implementing a sound, data-infused strategy, many real estate investors have seen incredible returns in a short amount of time. For example, Macario Escamilla experienced a 41.8% ROI on his historic Texas home flip in just thirteen days. Read more about his story here.

In order for $30,000 to truly be life-changing, you have to view it in light of your life as a whole. Whether it be through stocks, precious metals, or (our personal favorite) real estate, investing is the best way to increase the impact of $30,000, because long-term investing turns $30,000 into so much more.

To visualize what 30K will be worth in ten, twenty, or fifty years, consider this hypothetical scenario that illustrates the effects of investing money over time.

This illustration represents any investment strategy that yields a 4% annual return, which, as we’ve seen, is a quite conservative gain.

Source: Vanguard

According to these figures, a single $1 investment would turn into $1.48 in ten years or $2.19 in twenty years. Now apply that to $30,000. In ten years, $30,000 would become $44,400; in twenty years, the total rises to $65,700.

So what are you going to do with 30K?

If your plans for $30,000 –– or any other amount –– involve real estate investing, reach out to one of our agents near you. At New Western, we specialize in matching investors with properties that fit their needs.

Disclaimer: The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only.