The United States real estate market sees around six to seven million homes for sale each year. For investors, that number of potential properties can be overwhelming. How is a buyer supposed to find good deals in a pool of so many listings?

For many investors, developing an initial benchmark criteria can make all the difference when trying to separate the deals from the duds. That need for a preliminary standard led to the creation of the 2% rule in real estate.

But the 2% rule isn’t necessarily useful for every investor. We’ll consider the calculations, the pros and cons, and the alternatives that relate to the 2% rule in real estate.

What is the 2% Rule in Real Estate?

The 2% rule is an evaluation that compares the purchase price of a property with the monthly rental income. It’s a quick, back-of-the-napkin calculation that investors use when trying to determine which deals to look at more closely, because in theory, a property that meets the 2% rule will have a positive cash flow. In reality, the 2% rule is more of a guideline, one that can and should fluctuate based on current market conditions.

How to Calculate the 2% Rule

To calculate the 2% rule when the current rent is known, divide the rent by the purchase price. For example, if the tenant is currently paying $1500 per month and the purchase price is $135,000, divide 1500 by 135,000 to get 0.011 or 1.1%.

If the property isn’t currently rented or the rent is unknown, multiply the purchase price by 0.02 and evaluate whether or not the area can support that rental rate. For example, if a home is listed at $135,000, you would multiply that price by 0.02 to get $2700. This should be the rent charged under the 2% rule.

Investors might also use the 2% rule in reverse when determining an offer price. For example, if the current renter is paying $1500 per month in rent, the investor might multiply that amount by 50 (the inverse of 0.02) to set a max offer price of $75,000.

How to Evaluate a Property Using the 2% Rule

If the numbers above feel a little extreme, don’t worry. Calculations are one thing; evaluations are another thing entirely.

What the 2% Rule Tells You About a Rental Property

In theory, the 2% rule tells you if you should look more closely at a property. Basically the 2% rule gives a cursory first look at profitability. It’s a simple ratio between expected rental income and total purchase cost that’s designed to give the investor a way to quickly weed through multiple property listings.

However, in reality, certain markets rarely, if ever, see properties that fit the 2% rule. Investors using the theory of 2% would weed out all listings, in that case, so a strictly applied rule would tell them nothing. We’ll discuss this more below.

What the 2% Rule Doesn’t Tell You About a Rental Property

Since the 2% rule only factors in rent and purchase price, there’s a lot that it doesn’t take into consideration. Again, in theory, a 2% ratio would create enough margin to cover expenses and give the property a positive cash flow. But the following location-related elements are often too variable to fit neatly into the 2% rule’s general estimations.

Vacancy and Turnover

Every investor should be accounting for at least a 10% vacancy rate, but some places experience even more turnover and vacancy than others. A house with a low price point may fit into the 2% rule, but it may be located in a neighborhood where tenants are less reliable on rent payment and/or eviction is more common.

Vacancy is a cash flow killer because it represents a loss of income while operating expenses remain the same or even increase (if the tenant was paying utilities, for instance). Also, you may be hit with unexpected turnover expenses such as repainting or deep cleaning.

As you dive deeper into your due diligence when evaluating a deal, be sure to look at vacancy and turnover rates in the area. Local real estate agents and property managers can be some of the best sources for this information. Our New Western team can also help with this analysis.

Maintenance

Ideally, maintenance costs should also be covered by the 2% rule’s theory. After all, it’s considered a normal operating expense. A general maintenance budget runs around 1% of the cost of the home each year. That would include things like lawn maintenance, powerwashing, repairing a leaky faucet, or resealing the tiles.

But some locations see regular maintenance costs that are far from what other locales would consider normal. This might be based on climate. For example, colder states might see higher costs associated with snow removal, freeze damage, or window sealing. Wetter, more humid states will have to deal with moisture issues like mildew and wood rot. Maintenance costs can also fluctuate based on local service labor costs. In Delaware, plumbers make more than $40 per hour on average, whereas in South Dakota, they make closer to $14 per hour. In addition, older homes tend to have higher maintenance costs –– perhaps up to 3% of the home’s value each year.

If an investor goes simply by the 2% rule thinking that it should roughly account for maintenance, they may be unpleasantly surprised when actual maintenance costs eat up all their expected cash flow. As you’re researching a deal, look up average maintenance costs in the area, or better yet, ask the previous owner for maintenance expense data on the home if you can.

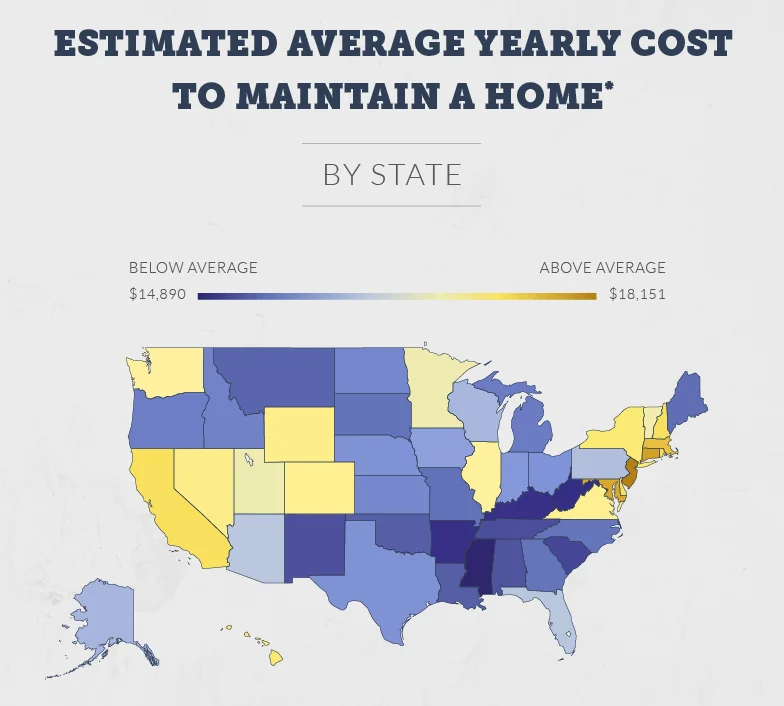

Image source: Porch

Property Taxes and Insurance

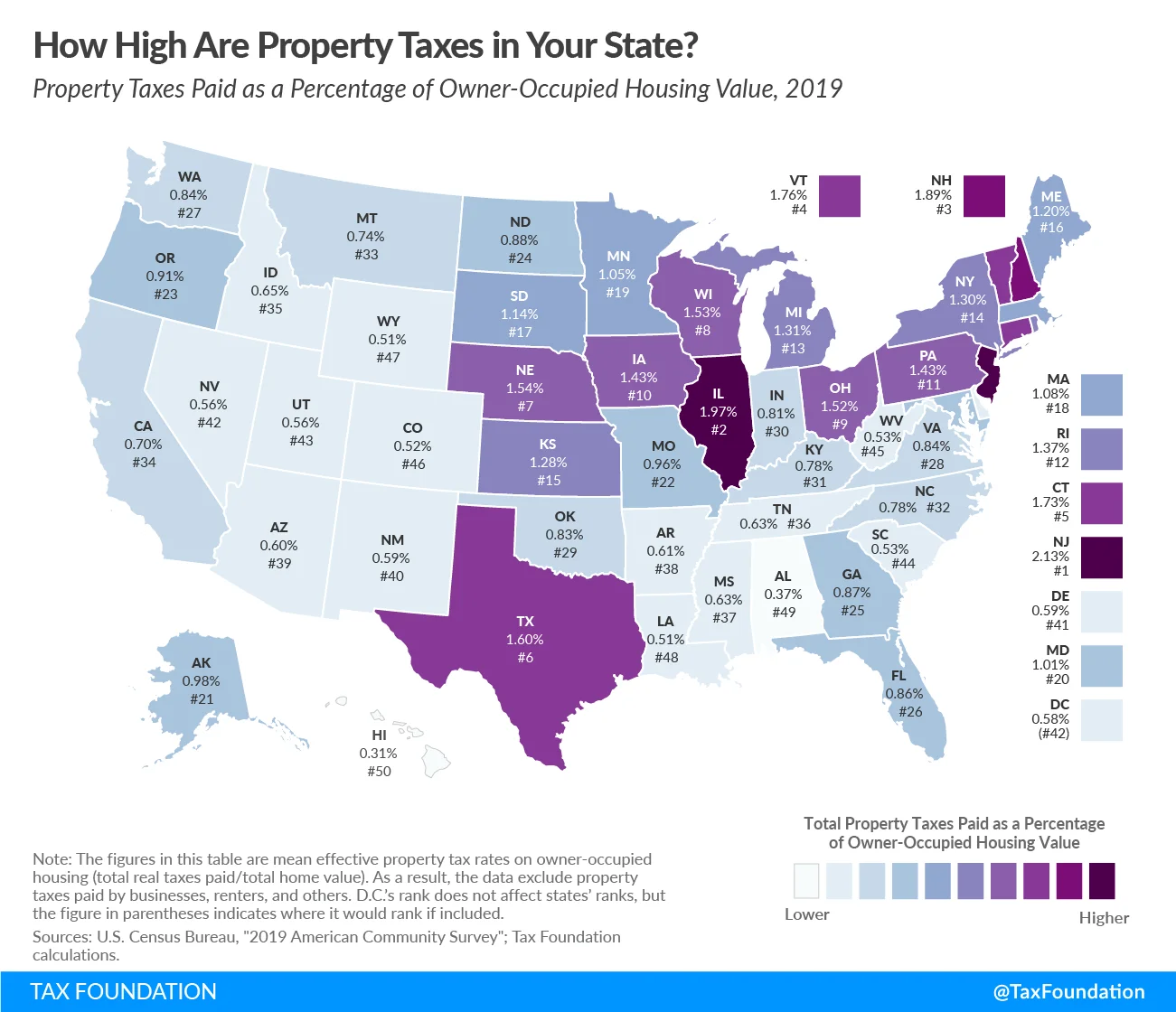

Property taxes are another element that varies greatly depending upon location. A property owner in New Jersey may owe double the amount in property taxes when compared to a similarly-valued property in Oregon. Also, local taxes vary within states, so a home in a metro area may cost significantly more in taxes than a rural property in the same state. The generalities of the 2% rule does not account for this wide property tax fluctuation, so investors should always investigate property taxes before making a deal.

Image source: Tax Foundation

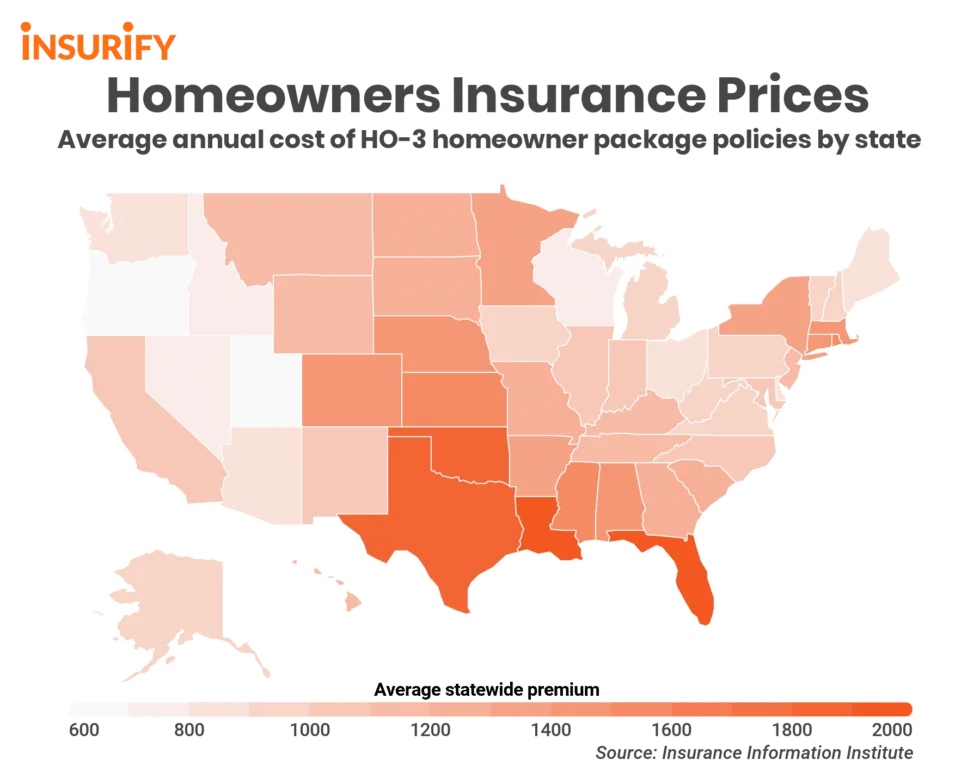

Similarly, homeowners insurance (or landlord insurance) is not priced equally across the country. Homes in coastal states –– and more specifically, in coastal counties –– tend to see much higher homeowners insurance premiums when compared to homes in states like Idaho and Nevada. When insurance bills differ by thousands of dollars, that affects the cash flow analysis for an investor.

Image Source: Insurify

Basically, the 2% rule is merely a starting point, and it should never be the deciding factor on making a deal. A property may meet the 2% rule on paper, but when things like vacancy, maintenance, taxes, and insurance are really researched, the deal might start to become less and less appealing from a cash flow perspective.

What About the 1% Rule in Real Estate?

The 1% rule works in the same way as the 2% rule, only with a slimmer criteria for cash flow success. The calculations are figured the same way: monthly rent divided by purchase price. The investor who uses the 1% rule just has a lower threshold at which they will investigate further into a property.

Take the above scenario for example –– the one in which the tenant was currently paying $1500 per month and the purchase price was $135,000. Doing the quick math showed us 1.1%. If the investor was using 1% as their rule of thumb, they’d want to take a closer look at the numbers on that particular property, whereas they may not be interested if the 2% rule was their benchmark.

When it comes down to it, the 1% rule is probably more applicable in many real estate markets these days. Most areas of the country continue to function as sellers’ markets, making it more and more difficult to find deals with the profitability margins represented by the 2% rule. To utilize the 2% rule effectively, there should be a large inventory of houses for sale so that the 2% rule can be used to skim the best prospects out for further review. In a seller’s market, supply is lower, demand is greater, and prices are higher, so when an investor uses a generous skimming process like the 2% rule, they’re likely to turn up fewer (if any!) prospects.

That’s where the 1% rule comes in –– yes, it’s technically lowering your standards. But when the standard proves unrealistic, flexibility and adaptability become necessary virtues. The problem of too-few prospects under the 2% rule isn’t new, either. Many metro areas never saw the kind of margins that could support the 2% rule, even during the real estate investment hayday of 2010-2012.

Advantages and Drawbacks of Using the 1% and 2% Rules

The main advantage of using the 1% and 2% rules is the ease in which you can ballpark a property’s viability. Investors who are faced with a hundred properties can use these 1% or 2% guidelines to quickly weed out options that they don’t consider worth looking into further. When used as an initial, round-numbers kind of evaluator the 1% or 2% rules have their place.

But as mentioned above, the 1% and 2% rules are lacking in terms of serious number crunching, and as such, investors who use them as hard-and-fast rules might miss out on profitable deals or make deals that turn out to be less profitable. Bottom line: you need more data to determine your own bottom line!

In addition, today there are not many markets that truly support the 2% rule. Five or ten years ago, the 2% rule might have been an investor’s go-to. But with increasing market prices and plateauing rents (in cities), a 2% margin has become near impossible. Add in greater demand from more investors trying to enter the game, and you’re looking at a rule that’s becoming more and more antiquated.

Can You Convert a Property Into One That Meets the 1% or 2% Rule?

Given the fact that rents tend to go up over time while the purchase price remains the same, it’s certainly possible for a property to become a 1% or 2% rule follower. Of course, in reality, you’d probably have capital expenditures that add to your cost basis over that time as well, so again, that number is more fluid than concrete.

Speaking of capital expenditures, property improvements can also help you get closer to a 1% or 2% ratio, as long as those renovations lead to an increase in rent. Buying a fixer-upper at a low price point and making upgrades that allow you to charge rent on the upper end of market norms is another way to get a property closer to the rules of thumb. But, again, there’s a cost to all those renovations that the rules don’t really account for.

In both of the above scenarios, it’s probably more practical to compare the current rent to the current fair market value (FMV) instead. Both situations would represent an increase in property value – the first by appreciation and the second by added equity. Looking at the fair market value would be a more accurate indicator of how your property is performing in terms of rent ratios.

What Is a Good Annual Return on Investment For a Rental Property?

As we’ve seen, the 1% or 2% rules are only enough to get you started. Before purchasing a property, you’ll want to do more in-depth analysis. The million-dollar question that every investor wants to know is: what’s a good return on investment for a rental property? But the answer depends both on how you define “return” and how you define “good”. Here are a few metrics to consider as you’re sifting through properties.

- Cash Flow: If you’re contemplating the 1% and 2% rules, cash flow is probably a good success marker for you. To calculate, simply subtract expenses from income, either on a monthly or yearly basis. To make the projection as accurate as possible, make sure to include all known expenses like mortgage, taxes, insurance, repairs, management, HOA, and vacancy reserves.

- Cash-on-Cash Return: Take the annual cash flow and divide it by the initial cash out of pocket (down payment + closing costs + rehab costs) to get cash-on-cash return. Many investors want to see 6% to 7% or higher for this number.

- Net Operating Income (NOI): Net operating income is similar to cash flow, except it does not take the mortgage into account. Subtract all operating expenses (other than the mortgage) from all income to get NOI.

- Cap Rate: Cap rate is what a lot of investors really mean when they think about return on investment for a rental property. To figure cap rate, take your yearly NOI and divide it by the total purchase price. Anywhere in the 5% to 10% range is considered a good cap rate return.

While the 1% and 2% rules may be useful for some investors, it’s important to remember that good properties don’t always abide by rules of thumb. Keep an open mind and get creative with your investment property searches. Our team at New Western is trained to think outside the box when it comes to investment opportunities. Let us help you find your next perfect property and show you how to evaluate investment criteria that goes beyond the 1% and 2% rules.