At New Western, our vision is a world where every real estate transaction is simple, certain, and satisfying. Therefore, we promote strict editorial integrity in each of our posts.

Rental property tax deductions are one of the biggest perks of being a real estate investor. Current tax laws allow for most expenses to offset the income gains produced by a rental property in the form of deductions.

But not all expenses qualify as deductions, and plenty of allowable deductions are overlooked by new investors every year. In this guide to rental property deductions, we’ll explain twenty-six of the most common write-offs for investors, link to current IRS forms and publications, and offer a checklist to make sure you’re taking advantage of all the tax breaks available to you.

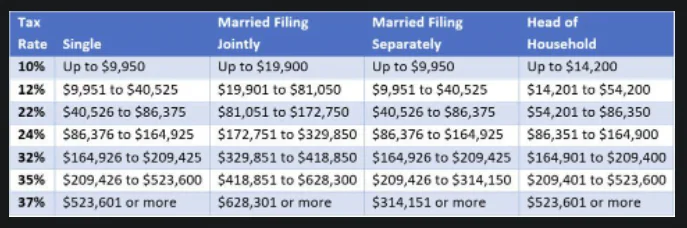

Rental income is the net amount received in rent from a tenant before any expenses are deducted. Rental income is subject to income taxes, whether filing as an individual, filing jointly, or filing as a business.

For individuals and joint filers, taxable rental income is added in with any other income sources, such as income from W-2 or 1099 jobs.

Rental property tax deductions are expenses that reduce the amount of rental income that is taxed. Not all expenses are tax-deductible; only those categorized as such by the IRS can be deducted.

Tax-deductible rental property expenses are tabulated by type and then subtracted from the rental income to create a taxable rental income. This figure –– which is often considerably lower than the rental income –– is then added in with other sources of income to be taxed at the filer’s tax rate.

As “above the line” deductions, rental property tax deductions are calculated separately from an individual’s or joint filers’ regular tax deductions. That means, individuals and joint filers still qualify for itemized or standard deductions on their income tax forms.

To better illustrate rental property tax deductions, let’s consider a round-numbers, hypothetical example.

Rental income: $24,000

Operating expenses: <$8,000>

Owner expenses: <$5,000>

Depreciation expenses: <$7,000>

Taxable rental income: $4,000

In this rough (but not unbelievable) example, the property brought in a net income of $24,000 and made a positive cash flow of $16,000, but the owner would only be taxed on $4,000 of income.

Because deductions reduce the amount of taxable income, they make a huge difference in how much tax is owed. See below for more information on the actual reporting and filing of taxable rental income.

2021 Tax Rates, source: Forbes

The IRS has created a list of authorized expenses that are tax-deductible for landlords in Publication 527. We’ll explain the most relevant deductible items here and offer a simplified table for reference below.

Deductible expenses can be unofficially grouped into three categories. Operating expenses refer to costs directly related to the property.

Ownership expenses include costs that the property owner incurs during the course of doing business. Depreciation expenses are “paper expenses” that affect how the IRS views the asset, but they are not really an out-of-pocket expense.

When an investor is looking to determine cash flow, they usually deduct the following operating expenses from net rental income, all of which are tax-deductible.

Local property taxes remain fully deductible for landlords under the Tax Cuts and Jobs Act (TCJA), even though there are now limits to the deduction for a primary residence. Landlords should break out and itemize the total paid for property taxes, even if it is paid in escrow via their monthly mortgage payment.

Property insurance is tax deductible for landlords, just as it is for primary residences. In addition, if the landlord has rent default insurance (a type of insurance that protects against a tenant’s failure to pay rent), it too is tax deductible.

Normal maintenance and repairs are tax deductible. This might include repainting the interior, replacing a broken toilet, rekeying locks, repairing ripped screens, replacing damaged flooring, and much more.

Landlords should be cautious about the difference between normal repairs and capital expenditures, though. Major updates, such as a kitchen remodel or roof replacement, are usually not tax deductible in the traditional sense, but may be depreciated over time (see below).

The property owner should be able to prove that the expense was necessary and routine, rather than a cosmetic renovation or even an energy upgrade. For example, replacing a broken window is normal maintenance; upgrading all windows to improve energy efficiency is a capital expenditure. Consult a tax professional if there are questions about classifying these types of expenses.

Some property owners –– especially those who own multi-family units –– will collect costs for utilities from the tenant and pay the utility bills themselves. If that’s the case, the amount collected should be included in the rental income, and then deducted as a utility expense. This category may include water, electricity, trash collection, and other basic utilities.

Costs associated with hiring and retaining a property manager should be deducted as well. All property management fees including tenant placement, ongoing management, and one-time services can be deducted from rental income.

Expenses related to listing the property for rent are tax deductible. Appropriate expenses may include signage, photography, website costs, platform fees, printing flyers, and more.

In addition to the diverse tax-deductible marketing expenses, for those aiming at exceptional tenant attraction strategies, investing in high-quality brochures can make a significant difference. Utilize a brochure printing tool designed to enhance your property’s visibility and appeal.

Similarly, any costs related to placing a tenant qualify as a deduction. If the landlord pays for application and screening services –– such as credit checks, background checks, eviction reports, and more –– these can all be deducted. But if the applicant assumes those costs themselves, the landlord cannot deduct them.

Any regular services acquired for the ongoing maintenance of the property can be deducted from rental income. This might include a cleaning service, pool service, lawn service, snow removal service, landscaping service, pest service, and more.

Hiring a professional to work on a business-related aspect of your rental property is also deductible. An accountant might prepare your taxes. A lawyer might work on a lease or eviction.

A bookkeeper might handle day-to-day accounting. All these professional services are deductible. Online support, apps, and software costs qualify too!

If the rental property’s community is subject to a Homeowners Association, any dues or fees charged by the HOA are tax deductible. However, large assessments may need to be depreciated rather than deducted (see below).

In some states, investment properties are subject to occupancy taxes, also known as sales and use taxes. Occupancy (and related) taxes are usually applicable only to short-term rentals, though each state has its own set of tax laws.

If your property is subject to an occupancy-related tax, the amount paid can be deducted from rental income.

In addition to operating expenses, the IRS views the following owner expenses to be tax-deductible as well.

While mortgage interest is usually left out of cash flow calculations, it can be included as a tax deduction. Payments on the principal are not tax-deductible, though.

Lenders will itemize and report the total interest paid at the end of the year for tax purposes. While primary residences have limits on the mortgage interest deduction, landlords can still deduct the total interest paid.

Mortgage insurance (PMI) fees are also tax-deductible. Basically, any debt service expenses can be deducted, but not the debt (principal) itself.

Some closing costs associated with purchasing a rental property are tax-deductible in the year that they were paid; others get wrapped up in the total cost of the asset and can be depreciated over time.

In general terms, debt services, broker commissions, and real estate taxes can usually be deducted in the year of purchase, while fees related to title insurance, county recording, and transfer taxes cannot.

Tax professionals will want to see the HUD statement in order to break down which closing costs are deductible and which are not.

Home offices have become so commonplace that the IRS came up with a simplified home office deduction. If you use part of your primary residence exclusively as your place of business (office), then you can deduct related costs.

The standard deduction is $5 per square foot, up to 300 square feet, or expenses can be itemized if that’s preferred.

Similarly, office costs are considered deductible. This may include office supplies, such as printer cartridges, paper, pens, etc., as well as accessibility costs, like internet and phone plans that are used for business purposes.

In addition, any necessary legal forms, such as costs to obtain lease templates, can be deducted.

Travel to and from a local rental property can be deducted at a mileage rate or on an actual-expense basis. The current standard mileage deduction rate is $.56 per mile.

When going to visit out-of-town properties or scout potential properties, the cost of travel can be deducted on a reasonable basis. Documentation is imperative for this expense to be considered legitimate. See more about what kind of travel expenses are not deductible below.

Some meals are considered a deductible expense. In their local area (40 miles from home), landlords can deduct 50% of meals eaten with business associates and can deduct nothing for meals eaten alone.

For owned properties located outside their local area, investors can deduct 50% of all meals. When going to look at prospective properties, though, no meal costs can be deducted. Documentation is key here, too –– investors should be able to prove the purpose of all meals!

Any licensure or license renewal expenses, such as business registrations, LLC status fees, or sales and use tax applications, can all be deducted from rental income. This includes any required annual health and safety inspections as well.

If your property suffers damage from theft or casualty, the costs associated with restoration can be deducted for tax purposes. Beware the distinction: deductible losses are physical in nature; loss of income from vacancy cannot be deducted.

Conferences, books, seminars, and classes designed to enhance the landlord professionally can all be deducted. However, it must be related to real estate investment or landlording somehow. Classes for personal betterment or in pursuit of a career change are not deductible.

Similarly, any business-related dues and subscriptions are tax-deductible. This may include real estate magazines, investor networking club dues, online resources, ongoing data reports, etc.

Qualified business entities (QBI) or pass-through businesses are entitled to a 20% deduction in business income under the Tax Cuts and Jobs Act. A pass-through business is one that doesn’t report taxes on its own, but rather passes income and tax liability to the business owners.

Investors who have their real estate businesses set up as LLCs, sole proprietorships, partnerships, or S-corps might be considered a pass-through business and thus be eligible for this deduction.

The pass-through business deduction is full of nuance, though, with plenty of restrictions, qualifications, and complications. Investors should seek the advice of a tax professional before claiming this deduction.

Finally, large expenditures can be depreciated over time for a significant tax deduction.

Investment property owners are allowed to write off the cost of the property over 27.5 years (for residential property), which means that every year, 3.636% of the total value of the building can be deducted from income for tax purposes.

There are a few caveats, however. First, only the value of the building can be depreciated; in the eyes of the IRS land can never be “used up” and therefore can’t lose value or depreciate.

Second, investors need to be aware of the concept of depreciation recapture. When selling the rental property, investors will pay capital gains tax on the profits –– the difference between what they bought it for and what they sold it for. However, when utilizing depreciation, the original cost basis amount decreases in the eyes of the IRS, therefore increasing the amount subject to capital gains tax.

For example, let’s say a house was purchased for $200,000 and sold for $250,000. Over the years, the owner deducted $25,000 in depreciation. So for tax purposes, the asset had a worth of $175,000 but sold for $250,000, making $75,000 (the difference between the two numbers) subject to capital gains tax.

If the owner had not taken a depreciation deduction, only $50,000 (the difference between the two original numbers) would be subject to capital gains tax.

That being said, most tax professionals and financial advisors agree that it’s worth it to take the depreciation deduction now, since the future is always uncertain.

The thought is: better to save money on taxes now, invest the savings, and sort out capital gains when you have a lump sum profit on-hand anyway. But every situation is different, so investors should talk through the pros and cons with their accountant or financial advisor.

As mentioned above, capital expenditures need to be depreciated over time (rather than deducted outright) as well. Replacing the roof, creating an addition, upgrading the windows, etc. –– these may be examples of capital expenditures that need to be depreciated by the same 27.5 year rule. Talk to your tax pro if there’s a question about the line between capital expenditures and repairs.

Some big capital expenses, such as appliances and fences, can be deducted more quickly. Breaking out, or segmenting, these expenses may be more work for the preparer, but they can provide greater tax savings per year. Examples include:

Watch out for expenses that cannot be deducted. Again, asking a tax professional can be the key to avoiding audits and back taxes on deductions that were taken incorrectly.

Rental income and expenses should be itemized on Schedule E. Expenses are reported by category. Meaning, that you’re not going to list out every $5 receipt for nails and plumbing elbows, but you’ll total them all up and report on the line for “Supplies”.

Income and expenses for each property will need to be listed separately. Once you have a total – income or loss – on Schedule E, it will be reported on Schedule 1, line 5, added to any other income, and transferred to the main 1040 form on line 8.

All of them! Every transaction and expense should be backed up by a receipt, ideally, one that lists the nature of the expense. Take lots of pictures in order to prove necessary repairs. Keep all email and text threads with brokers to prove the legitimacy of scouting trips.

When deductions exceed rental income, then the rental property has a loss on the year –– for tax purposes anyway.

Due to the passive income loss rule, loss from one rental property can typically only be used to offset gains from another passive income source (such as another rental property or other investment) but it cannot be used to offset active income (from a W-2 or 1099 job).

However, losses can be carried forward and applied instead to passive income in a future tax year.

Rental property deductions present huge tax savings for investors. The checklist here is meant to help with common rental property deductions, but other less-common deductions and credits may apply to certain people.

Investors should seek the help of a tax professional to ensure that they’re utilizing all deductions to the fullest extent of the tax law. As always, our New Western team is available to help you find rental properties so you can start putting this checklist to use. Connect with us today!

Disclaimer: The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only.