At New Western, our vision is a world where every real estate transaction is simple, certain, and satisfying. Therefore, we promote strict editorial integrity in each of our posts.

It is no secret that investing money rather than keeping it stored away in the bank can be a great way to take your profits to the next level. However, you also probably know that selecting the right investment strategy and executing it to perfection is no simple task. If it was, everyone would do it!

When you hear the word “investor”, the terms “stock market” or “real estate” are likely top-of-mind. That’s because these are both popular investment avenues, but which is the better bet?

Investing in real estate and stocks each have so many unique pros and cons that it can be difficult for new investors to know which of these avenues to choose. Both are relatively reliable long-term bets that have the potential of yielding high rewards for skilled investors.

It’s sometimes assumed that you need a lot of real estate knowledge to successfully profit from this market, but that’s not necessarily the case.

If you can get a reliable agent and an experienced brokerage on your team, you’ll be in a great position to pick and maintain some profitable real estate investments.

Here are seven reasons to invest in real estate over the stock market.

The housing market is typically more predictable than the stock market. There are many signs that house prices are likely to grow in a specific region, which seasoned investors spot and take advantage of.

These signs include:

Gentrification, via the arrival of up-market retailers, cafes, bars, and restaurants, is another tell-tale sign of future house price growth.

It’s simple enough to pick out the next up-and-coming area because gentrification often spreads from a town’s core outwards. As the demand for property in that area increases, prices rise.

However, this means you’ll also have to beat out other investors looking to get in on the next trendy area. It can be very helpful to work with an experienced agent who can help you find great deals.

The signs of a profitable business are less clear cut, as there are more obstacles that can stop it from thriving.

The level of risk involved is a major factor to consider when deciding between investing in real estate vs stocks. Of course, as with any investment, the level of risk and return depends largely on how well you manage it.

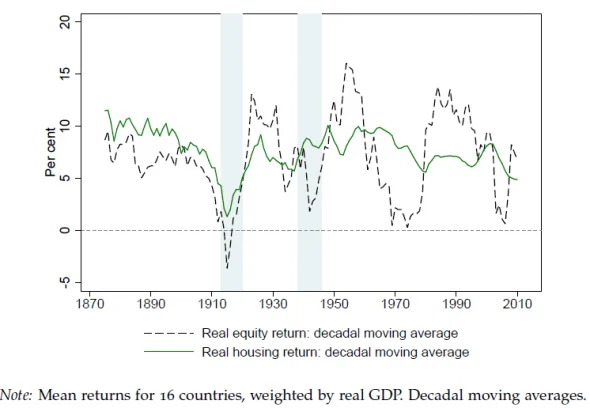

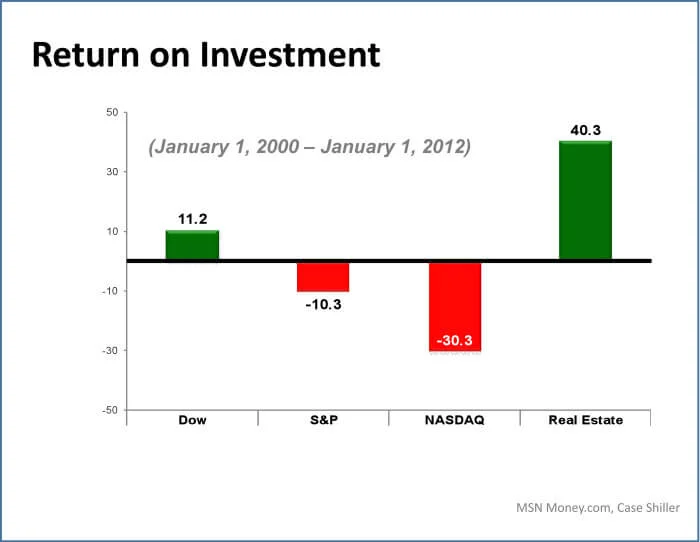

Generally speaking, real estate tends to be much more stable and provides higher returns overall when compared to the stock market. Take a look at the chart below and compare equity returns in both types of investments over the past 150 years.

One of the many reasons that real estate is lower risk than the stock market is that the assets are tangible and less subjective to emotional buying and selling. When the stock market starts to take a downward turn, many people act quickly to ditch their stocks to save what capital they have left.

With real estate, on the other hand, it’s not that easy to sell at the drop of a hat, so investors tend to ride out small turns in the market and plan their exit more strategically.

As discovered in a study by the research firm Dalbar, Americans generally lack the patience needed to hold on to stock market investments for more than 3 years.

This is less of a problem in real estate vs stocks because investors have a feeling of security by having a tangible asset and offloading properties takes a lot more time and strategy.

As well as identifying profitable areas, an experienced investor can develop a reliable nose for profitable properties.

One of the easiest ways to do this is to invest in properties that are in a state of disrepair. In fact, there are many professionals who make a good living out of buying under-developed or run-down properties, completing the repair work, then selling them for a profit.

Once you get a sense of how much it will cost to upgrade the property and how much the other properties in the area sell for, it’s simple enough to make smart investment decisions.

If you have the right partnerships, you don’t have to spend your own time looking for damaged buildings or signs of gentrification either.

By working with New Western, an agent can match you to on and off-market deals that fit your investment goals so you can pick your next project property from an already groomed shortlist.

It’s been statistically proven that the real estate market is typically less volatile than the stock market in the short-term.

The stock market is very sensitive to the performance of local economies and currencies. Property prices are affected by these factors too, but not as dramatically or quickly as what can occur with the prices of stocks and shares.

When investing in real estate, your cash flow should change with inflation if you choose to hold on to your property as a rental.

The fair market price for rent changes from year to year. By keeping an eye on what neighboring property values, you should be able to keep up with the changing trends.

Rental properties not only provide a consistent, monthly payout, but they can also be leveraged to help you secure your next investment opportunity. Most real estate investors choose to use hard money loans to fund their projects.

This type of loan is ideal for investors because it allows you to lend money based on your already owned property; not based on your credit or any personal factors.

This allows you to free up additional cash flow to expand your investment empire. Typically, this also allows you to purchase your next property with less money down.

Savvy investors know all about the many tax advantages available to them simply because they chose to invest in real estate vs the stock market. One of the many opportunities that investors love to take advantage of is the depreciation tax credit.

With an investment property, landlords are able to deduct depreciation from their tax liability. Often, investors can depreciate assets that did not decrease drastically in value and use their tax savings as additional cash flow.

Many real estate investors like pumping money into physical assets they can actually see.

It’s a comfortable psychological barrier for them. Many believe they’re less likely to be scammed when investing in property, as they can inspect it themselves. With stocks and shares investing, you have to rely on written details a lot more.

Perhaps one of the biggest bonus of investing in real estate vs stocks is that you can move into it one day if you choose to. If the stock market crashes, you will likely not have much to show for your investment.

But, if things do not go according to plan or you decide you want to exit the real estate investing game, you always have the option of moving into your property and making it your own. Why not buy that holiday home now, then have the option to retire there in a few decades?

Commonly-cited reasons to avoid real estate investment include troublesome tenants, maintenance, repairs, rent arrears, and void periods.

However, if you hire a reliable leasing agency, you’ll barely have to worry about any of these downsides yourself. The agency or property manager will take care of all these issues for a monthly fee. This will allow you to relax and pick up the remaining profits.

Some landlords actually enjoy being more hands-on with the property and their tenants, so it’s not necessarily a stressful task.

This is especially true once you can find trustworthy long-term tenants. The beauty of investing in real estate instead of the stock market is the ability to choose your level of involvement.

As with any investment, real estate provides risks. You shouldn’t put any money into a property without investigating it yourself, and you should be comfortable in the knowledge that house prices can drop as well as increase.

By following these tips, you can dramatically reduce these risks and feel confident that your real estate investments will grow.

Working with an expert agent will put you well on your way to real estate investment success. New Western agents can connect you with on and off-market properties to help you achieve your investment goals.

Disclaimer: The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only.