New Western’s Monthly Market Snapshot – August Edition

Key Takeaways for Independent Investors In August

- Inventory is rising slowly but pricing is still high

- Local investors are nearly outpacing builders putting new affordable inventory in the housing market

- Rent rates have become more competitive because of new apartment building construction but renters still want single-family homes

Inventory and New Construction

Inventory is rising but home prices are rising, too. Mortgage rates will likely decrease following anticipated rate cuts from the Fed in September resulting in more buyers and sellers in the market. But home prices are still predicted to grow, just at a slower pace.

June marks the 149th month in a row for year-over-year home price increases. In May 2024 the increase was 5% year-over-year and in June that increase shrunk slightly to 4.7%. Inventory of affordable homes remains tight and continues to present a solid opportunity for local investors to sell their flips.

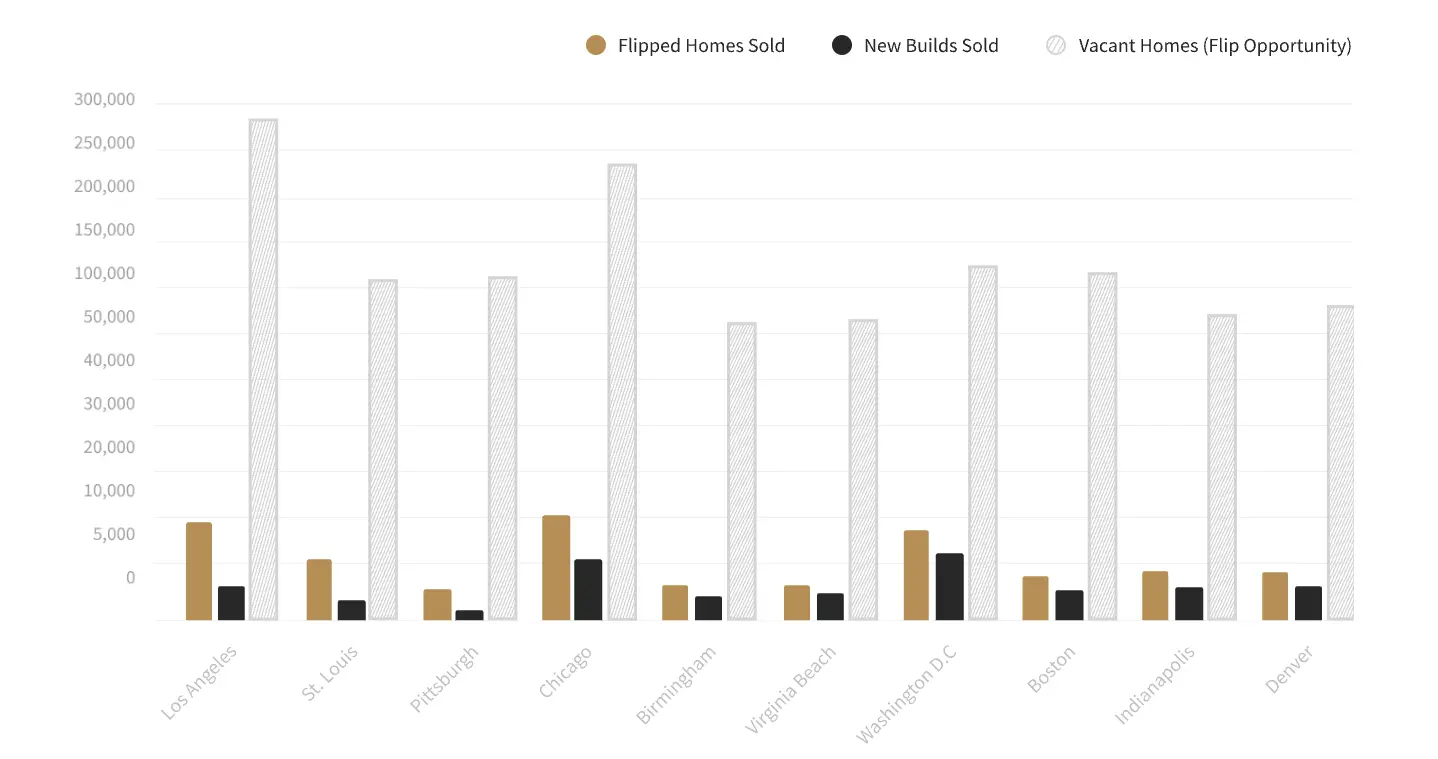

New housing inventory is primarily being supplied by two sectors: builders and local investors. But new construction can’t keep up with the demand for housing, particularly starter homes, alone. In anticipation of ongoing elevated mortgage rates deterring buyers, builders have slowed construction, but demand still remains for all homes in the affordable range. While builders remain cautious, local investors are selling more flipped homes than builders in several markets and are close to matching those numbers in others across the country. There’s endless opportunity for flippers to bring additional liveable inventory market. Many longtime homeowners are aging out of their homes, ready to downsize. Millions of vacant and aging homes across the country are prime for rehabbing and returning to market.

Flipped Homes vs New Builds Sold

Flipping and landlording

Independent investors and new construction are the two major players providing new inventory to the housing market. Both players offer a new product for homebuyers but new construction is struggling to keep up with the demand for smaller homes.

Independent investors and new construction are the two major players providing new inventory to the housing market. Both players offer a new product for homebuyers but new construction is struggling to keep up with the demand for smaller homes.

In a survey conducted by the NAHB, 26% of buyers said they want homes under 1600 square feet but only 16% of new single-family homes were built this size in 2023.

These under-served buyers become an opportunity for investors to flip homes near desirable new construction communities. Local investors can also attract buyers by offering rehabbed homes under 2000 square feet near desirable city centers.

Rentals continue to be a draw for home searchers. The renter population grew in the second quarter by the largest percentage in recent years, leaving investors with options for expanding to new markets. The median asking rent fell for the first time since June 2020 across the nation, but rents are still competitive and demand still exists.

While rent rates are down about $50 a month across the board, new-construction apartment buildings with 3-bedroom units were overbuilt in major markets like Texas and Florida. The typical renter would rather pay for a single-family home than a large apartment at the same price. The renter market has become slightly more competitive, but opportunities for landlords with single-family homes remain strong.

Investor Opportunities

Local investors are key players in creating affordable inventory for the housing market. According to a recent survey of over 1300 New Western investors, they show no signs of slowing down in 2024 and 2025.

I’m excited to be part of the REvolution with local investors. We’re helping Americans achieve financial freedom and address the housing and affordability crisis. This ‘Great Renovation’ shows that builders and the government alone can’t fix our housing infrastructure issues. Every day local small businesses are making a real difference by flipping homes. With a shortfall of 4.5 million homes and millions of vacant and aging homes ready for renovation, these investors are just getting started in meeting community needs.”

Kurt Carlton

Co-Founder & President of New Western

Get to Know a New Western Investor Market – Birmingham, Alabama

Ready to take part in the Great Renovation? Birmingham, Alabama is a rapidly growing New Western market. With significantly lower housing prices than the national average, investors can enter the Birmingham market with less capital and grow a single-family portfolio.