At New Western, our vision is a world where every real estate transaction is simple, certain, and satisfying. Therefore, we promote strict editorial integrity in each of our posts.

When it comes to real estate transactions, the traditional methods of buying and selling are pretty clear-cut, but they also take a lot of time and money.

On average, closing costs have risen to $6,087 including taxes, and it takes around 50 days to purchase a home.

Many real estate buyers––especially investors––are curious about ways to reduce both of those figures. That’s where unconventional deals, such as subject-to property sales, become a lot more interesting.

“Subject-to” refers to a creative financing scenario used in real estate buying and selling. A subject-to property is a property that is sold with the existing mortgage still in place. The buyer does not assume the mortgage, but rather agrees to make the monthly payments to the seller. The seller remains the legal owner of the property until the mortgage is paid off.

The loan stays in the name of the seller, and as such, the home sale is literally “subject to” the contractual understanding that the seller will make on-time payments on the mortgage.

But the deed to the home transfers to the buyer as their property, the same as any other sale.

Subject-to deals are popular among real estate investors, because of the potential to capitalize on equity gains.

As interest rates rise, subject-to deals may also be a way for general homebuyers to take advantage of a seller’s fixed low rates from years past.

In subject-to deals, the remaining balance of the mortgage––the portion of the loan that the seller still owes––is considered part of the buyer’s purchase price.

In other words, the seller’s debt is counted against the agreed-upon price, since the buyer will now be “subject to” that debt.

Let’s consider a few examples in order to make the idea more tangible. There are a few ways that subject-to deals can be structured, depending upon the circumstances surrounding the sale.

A straight subject-to deal includes simply the seller’s loan balance plus any additional cash from the buyer to equal the agreed-upon purchase price.

Let’s say two parties––buyer and seller––agree that the purchase price for a home will be $120,000. The seller still owes $100,000 on their home loan.

The buyer will take over those mortgage payments in a subject-to deal, and will pay $20,000 in cash to the seller (the difference between the purchase price and the loan balance).

This straight subject-to deal is when the seller offers a carryback––also known as owner financing––to the buyer for a certain portion of the purchase price owed.

Let’s consider the same example: buyer and seller agree on a $120,000 purchase price, and the seller has a $100,000 mortgage balance.

But the buyer only has $10,000 in cash, so the seller offers owner financing for the remaining $10,000.

The buyer will then be responsible for two loan payments: the existing mortgage payment to the seller’s lender (on the $100,000) and the carryback payment to the seller directly (on the $10,000).

In a wrap-around subject-to, the seller offers the buyer an owner-financed loan that includes or “wraps around” the seller’s current mortgage, often at a higher interest rate.

Again, let’s use the same scenario above: $120,000 purchase price, $100,000 seller mortgage balance, $10,000 buyer cash.

In a wrap-around subject-to, the seller offers a single owner-financed loan to the buyer for $110,000 (the difference between the purchase price and buyer cash). The buyer makes one payment to the seller, and the seller continues to pay their mortgage.

In this type of deal, the seller may make additional profits by charging a higher interest rate than their current mortgage carries.

For instance, if the seller is paying 3% interest on their $100,000 mortgage, but charges the buyer 4% interest on the owner-financed $110,000 loan, they keep 1% on the portion of the payment that gets passed on to their original lender.

And of course, they keep the full 4% on the portion that’s fully owner-financed ($10,000, in this case).

Most sellers that agree to a subject-to deal are in some sort of distress. They may be behind on their mortgage payments and facing foreclosure, or they need immediate cash due to some sort of personal distress such as sickness or divorce.

A subject-to deal can help provide a quick solution to whatever problem they face. The deal usually happens relatively fast, with no buyer financing on the line and sometimes no title company involved.

In addition, sellers may be motivated by the possibility of improving their own credit and/or avoiding broker fees.

With a subject-to, they avoid foreclosure and rebuild credit, since the mortgage (which the buyer is paying) is still in their name.

The seller also avoids paying a real estate broker’s commission to list and sell their home, saving several thousand dollars in closing costs.

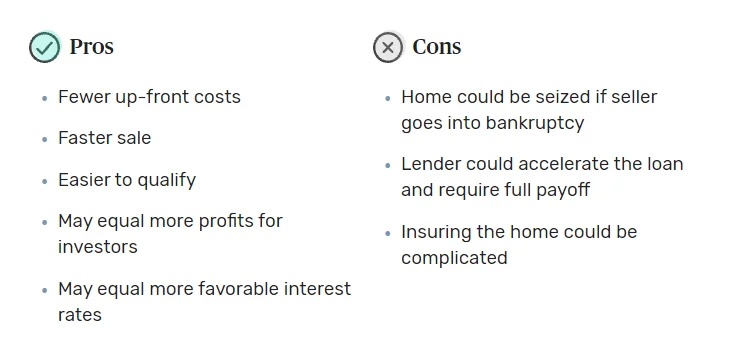

Buyers––or more specifically, real estate investors––are typically drawn to subject-to deals for the lower cash investment, fast closing, and potential profits.

Buyers save money on subject-to deals by avoiding closing costs. They’re also able to start any rehab and/or rental strategies quickly, which leads to profits either from increased equity or cash flow.

In a subject-to scenario, the buyer has great leverage to turn a relatively small investment into a much larger return, especially in cases where they are required to bring very little cash to the table.

For buyers in general, subject-to deals can be attractive because there’s no need for good credit (which a buyer would need in order to get a loan in their own name).

Buyers may also stand to benefit if the seller’s mortgage carries an interest rate that is below the current interest rate.

While a subject-to deal may sound good, there are still inherent risks to be aware of, especially because the loan remains in the seller’s name.

For the buyer, there’s a risk that the property could be seized if the seller goes into bankruptcy. The buyer owns the property by deed, but the property is still a legal liability of the seller.

The house is the collateral on the seller’s loan, which puts it into jeopardy for bankruptcy proceedings. If that happened, the buyer would lose all equity they have in the home.

For the seller, there’s a risk that the buyer may indeed default on the payments they’ve agreed to be subject to. If that happened, the seller would be held responsible (it’s still their loan), they would be foreclosed upon, and their credit would suffer.

In addition, both parties are at risk if the mortgage is written with acceleration or “due on” clause (which most mortgages have). When the property transfers hands, the lender has the right to call the loan due in full, if written with this type of clause.

Sometimes the lender forgoes or overlooks this right because they’re satisfied that someone’s making payments. But not always!

Finally, there may be hurdles to overcome in terms of getting the property inspected, surveyed, appraised, and ultimately insured.

Buyers and sellers should foster clear communication about these issues as they come up.

Source: the balance

Since most subject-to deals are precipitated by sellers in distress, they typically can’t be found on the MLS.

Buyers who are interested in subject-to deals will need to employ off-market strategies to find these types of properties.

Finding a subject-to property is a big feat, but it’s only the first step in the process. Here’s a potential step-by-step breakdown of what it may look like to pursue a subject-to deal.

- Identify a possible subject-to property.

- Talk to the potential seller. Be sure to discuss:

- Reasons for selling

- Property condition

- Possible sale price

- Current mortgage balance

- Any liens, second mortgages, etc.

- Any relevant zoning, HOA bylaws, or ordinances that might affect your strategy

- Analyze the deal.

- Find comps.

- Determine market value.

- Estimate after repair value.

- Calculate rental income and expenses.

- Finalize the deal with the seller.

- Go over the subject-to terms.

- Get a real estate attorney to review the contract.

- Sign the purchase agreement.

- Get inspection/survey, if stipulated in the agreement.

- Transfer ownership of the deed at either the county courthouse or a title company (depending upon local laws).

- Take possession of the property.

- Seller moves out.

- Obtain insurance.

- Start paying the seller’s mortgage.

- Start paying the property taxes.

- Begin relevant investment strategies.

- Rehab

- Rent

- Resell

The timing of the subject-to process will vary based on the particulars of the deal and the players involved, but with no contingencies, these steps can be completed relatively quickly.

Before moving into a subject-to deal, buyers and sellers should be sure they have a complete understanding of the process, the ramifications, and all potential hindrances.

Here are a few items of due diligence that should accompany subject-to deals.

Subject-to real estate deals can be a good option for both buyers and sellers under the right circumstances, as long as both parties understand the pros and cons. For assistance finding off-market real estate options, feel free to reach out to our professionals.

Disclaimer: The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only.