With rising prices in the national real estate market, investors are questioning the profitability of fix and flip opportunities more than ever. Is there room in today’s market to make income from a flip, when purchase prices have increased 15.9% year over year?

The answer is yes –– as long as you go about it the right way. Data from ATTOM, a leading fix and flip research company, indicates that median sales prices from flipped homes are higher than ever at $281,847. That’s a 22.5% increase when compared to the previous year. But even though sales prices are up, profits are down, with a gross return on investment of 32.3%, compared to 43.8% ROI a year earlier.

What do those figures mean for fix and flip investors? It means there’s still plenty of demand for flipped properties, but investors are going to need to be more savvy than ever in order to make the risk –– and the work –– pay off in profits at the end.

What Makes a Fix And Flip Real Estate Investment Profitable?

Let’s walk through the key components of a successful fix and flip project, in order to help boost the income on your investment.

The Right Location

While it may sound cliche, the real estate adage, “location, location, location,” holds true when it comes to an income-producing flip. Not every market has the demand or the margins of profit to make a flip worthwhile.

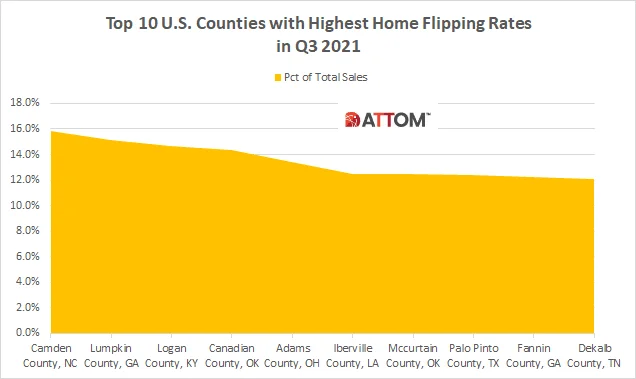

According to ATTOM data from 2021, the top metro areas for successful flips were Ogden, UT, and Phoenix, AZ, where flipped homes comprised 9.5% of total home sales. Other notable cities included Salisbury, MD (9.3%), Laredo, TX (9.2%), Memphis, TN (9%), and Oklahoma City, OK (8.8%).

However, bigger cities don’t hold a monopoly on successful flip stats by any means. The chart below shows smaller, suburban counties that have seen great rates of flipped home sales recently.

Source: ATTOM

When choosing a location for your flip, the key to success lies in finding a property in a desirable or improving neighborhood. That way, you have a better chance of being able to buy low and sell high after improvements. Look for signs such as rising real estate sales, healthy employment growth, and other economic trends that indicate a sizable pool of buyers. The idea is to find an area that buyers want to be in and a house that they don’t want to touch…yet.

A Realistic Project

According to NPR, “house flips are at an 11-year high.” That means there’s increased competition among real estate investors. With more players in the game, some investors can get hasty and make offers on homes that need more work than they are equipped to handle. Failing to properly vet properties can end up diminishing profit margins –– not a good strategy when the end goal is to produce income.

Most investors would agree that the ideal flip is a home that needs quick, cosmetic renovations — new floors, fresh paint, landscaping updates — rather than major repairs. In today’s crowded flipping landscape, finding properties that fit that description can be easier said than done, though.

That’s where New Western can help. Our exclusive listings are curated with investors in mind. We’re experts at helping our clients secure off-market properties which put them one step ahead of the competition.

If you’re the type of investor who isn’t deterred by a little more work, that’s fine. Roof replacement, mold removal, foundation repair, and other major rehabs don’t necessarily mean an instant rejection –– just make sure you go in with eyes wide open.

Before buying, bring in an inspector or other expert who’s knowledgeable in areas such as plumbing, electric, and structural issues to figure out exactly how much work the house needs. Knowing the extent of the project upfront will not only help you determine the right offer, it will help set a proper budget.

An Accurate Budget

In order to ensure your investment turns a profit, you need to be able to estimate the flip’s true costs. In an effort to judge initial profitability, some investors follow the 70% rule, which states that in general, you should aim to spend no more than 70% of the After Repair Value (ARV) on the project in total, including both purchase price and repair costs.

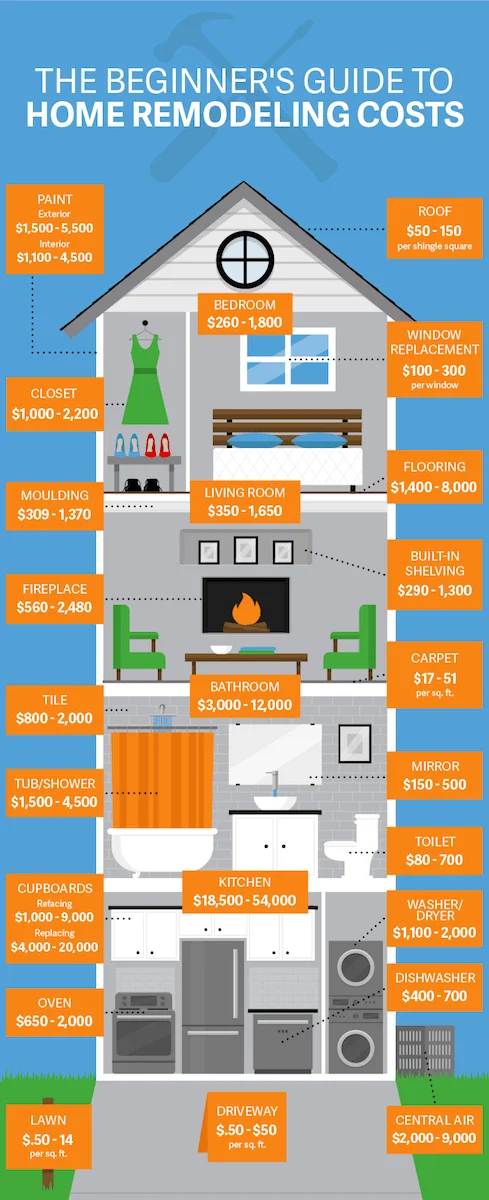

To do this, many investors start with their estimated rehab costs and let that number guide how much they’re willing to offer on the home. Begin by accounting for supplies and construction labor costs. Keep in mind that these days, construction experts estimate that costs have jumped around 30% when compared to pre-pandemic prices.

Don’t forget to add in “hidden” costs, such as dumpster fees, building permits, and more. Some investors add in a buffer of 20% to account for those expenses that inevitably pop up over the course of the project.

Source: SoloRealty

After you’ve tabulated all the repair costs and estimated your ARV, use the 70% rule to make an offer that has the best chance of bringing in income when the project is finished. Calculate 70% of your ARV, then subtract your rehab costs, and you’ve got your max offer price.

Solid Funding

Financing is also a key factor when it comes to bringing in maximum income from a flip. According to ATTOM data, cash is king for flippers nationwide; 60.4% of flippers purchased with cash in 2021’s third quarter, up from 57.7% just a year prior. And while financing a flip may be less common, it’s not unheard of; 39.6% of flipped homes in the same period were purchased with financing.

In a competitive marketplace, creative financing can make all the difference both in securing a property and turning a profit. Fix and flip real estate investors have several options available, including:

- Hard money loans. A hard money loan is typically a short-term loan financed by individuals or smaller entities. The interest rate tends to be higher, but the restrictions tend to be lower.

- Cash-out refinancing. This process taps into your personal home’s equity by refinancing. The idea is to cover your mortgage and pocket any additional cash (from accumulated equity) which can be used to finance your flip.

- Home equity line of credit (HELOC). A HELOC’s revolving line of credit uses your home equity as collateral and works somewhat like a credit card. It can be an option for funding flip rehab costs.

- Private investor or partner. Networking with like-minded investors could lead you to a silent (or not-so-silent) partner who’s willing to fund the flip in return for a percentage of the end profits.

- Subject-to properties. Subject-to deals refer to a buyer taking over the mortgage payments of the seller. New Western can assist in finding properties that fit into this unconventional financing criteria.

New Western can help connect you with solid financing options for your fix and flip. To get started, explore this guide.

A Tight Timeline

When flipping a house, a quick turnaround maximizes your income-producing potential. Why? Two words: Holding costs.

Holding costs (also known as carrying costs) refer to the expenses that you incur over time simply by owning the property. Holding costs include things like:

- Property taxes

- Property insurance

- Financing costs (interest on your loan)

- Utilities

- General maintenance fees (like lawn care or pest prevention)

- HOA dues

Holding costs vary greatly depending on the location, the size of the home, and the details of the sale. To ensure that your flip is profitable, calculate your total holding costs. Be aware of how every additional month before closing is eating into your end earnings, and set a tight timeline to minimize holding costs overall.

According to ATTOM’s latest report, “Home flippers who sold properties in the third quarter of 2021 took an average of 147 days to complete the transactions, the smallest turnaround time since the third quarter of 2010. The latest number was down from an average of 148 in the second quarter of 2021 and 189 in the third quarter of 2020.”

This data is great news for flippers generally, but remember to practice realism individually. Due to recent supply chain issues, more that 90% of builders are reporting significant delays. Seasoned investors build in a time buffer of up to 80% so that unexpected delays don’t break their profit potential.

Professional Resources

Whether you’ve got a few fix and flip real estate deals under your belt or you’re just starting out, seek the invaluable advice of those who’ve been there, done that. Reach out to your network to find mentors and learn from flippers who’ve been successful in your market in the past.

Purchasing a property to fix and flip is a big decision. New Western can help. Our experienced team of professional agents will help you identify an investment property with the potential to flip and not flop. If your goal is making income from a flip, we’ve got the resources to get you there.