Forward-thinking investors are always looking for the next step to get ahead in real estate. Sometimes that means being creative in how you structure your personal and business portfolios. But creativity has its limits.

Many investors wonder about the positioning of their businesses, their residence, and their properties. Is there a way for those three entities to benefit from each other as far as rent? Let’s dive into the details –– good and bad –– of renting from your own real estate LLC.

Can I Rent From My Own LLC?

The technical answer is, yes, you can rent from your own LLC. However, the real consideration isn’t about the legality of self-rental but rather the practical merits of the situation. In some cases, it’s wise to rent from an LLC that you set up for your property. In other cases, it’s foolish. To distinguish between the two, let’s first take a look at whether you need an LLC for your real estate rental in the first place.

Advantages of LLC for Rental Property

Creating an LLC for rental property can protect your personal assets, creates pass-through income and losses, and allows multiple members and a flexible ownership structure. Owning an LLC provides a more professional business and can potentially increase credibility in the real estate market.

The acronym LLC stands for Limited Liability Company. As the name implies, an LLC limits the liability of the company to the company. Limiting your liability is arguably the best reason to form an LLC for your rental property.

Liability limitation is especially important in the instance of someone getting injured on your property. If the injured person were to sue your property’s LLC in court, the extent of the damages available would be limited to the LLC; meaning, the settlement would not affect your personal assets.

Similarly, if you have personal debt, creditors can only go after your personal holdings, not your rental property. Forming an LLC creates a separation between your personal assets and your business assets, thus limiting the liability of each entity.

Having your rental positioned as an LLC can also be advantageous in regard to taxes. In general, LLCs follow pass-through taxation, which means that any income is claimed by the individual (similar to a sole proprietorship).

This is a tax benefit because LLCs can claim deductions not available to individuals and because you avoid double taxation. You can also opt to have the LLC taxed like an S-corp or C-corp if that’s a better structure for your situation.

Disadvantages of LLC for Rental Property

Although an LLC can create additional protection, asset protection is not guaranteed as individual members of that LLC can be liable for debts or damages. Other disadvantages of LLC for rental property include additional tax filings, annual filing fees, the possible self-employment tax and that an LLC is required for each state a property is in.

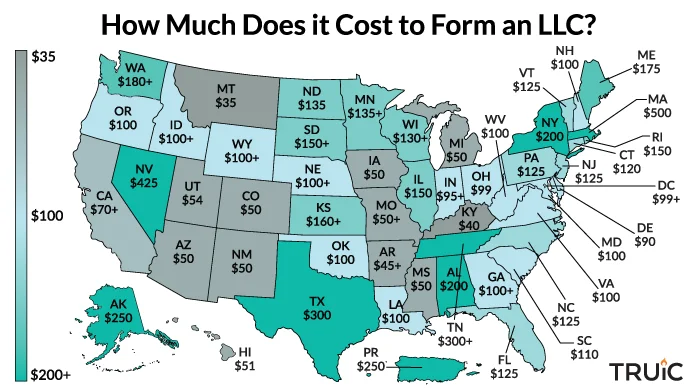

Creating an LLC for your rental property is not without a few disadvantages though. There is a startup cost for registering an LLC, which varies by state –– roughly between $40 and $500. You can also expect an ongoing annual fee to keep your registration up to date –– on average, around $90.

Image source: HowToStartAnLLC.com

There is also a fair amount of paperwork and forms to fill out when forming an LLC, so you can expect to sacrifice a bit of time on the front end. In addition, LLCs have different tax obligations that you’ll need to understand; it’s best to speak with a tax professional to determine how forming an LLC will impact your personal tax situation.

Should I Rent From My Own LLC?

As alluded to before, just because you can do something doesn’t mean that you should do it. Let’s look at when renting from your own LLC is a good idea and when it’s really not.

Yes, Rent From Your Own LLC When…

Established businesses are the most legitimate reason to rent from your own LLC. For example, let’s say you own and operate a coffee business, and you also own the building in which the shop is located. It’s in your best interest to separate the two entities by having the coffee business rent from the building’s LLC.

Having your business rent a property that you own through an LLC is a great way to protect both investments. If the business fails, the property asset is separate and cannot be liquidated. Similarly, if there’s ever a lawsuit brought against the property, your business assets are safeguarded.

From an accounting perspective, it may seem like you’re creating extra work for yourself. After all, why not just let the coffee business exist rent-free if it’s all your money anyway?

But renting from your own LLC is a good move financially in this case because rent is an allowable business expense. That means lower self-employment tax on the coffee business side.

And since rental income (which is taxable) can be offset by depreciation, you’ll probably end up paying less in taxes overall by renting from your own property LLC.

No, You Probably Shouldn’t Rent From Your Own LLC If…

Renting from your own LLC is not a good idea when it comes to your primary residence. The biggest problem arises from the creation of phantom income, which, all other considerations aside, is not advantageous for tax purposes.

That way, the LLC could deduct all the usual homeownership expenses as business expenses … right?

Wrong. In reality, renting your home from your own LLC doesn’t work for a number of reasons. The biggest problem arises from the creation of phantom income, which, all other considerations aside, isn’t advantageous for tax purposes.

Think about it this way: the rent you pay to your LLC isn’t a tax-deductible expense on your individual return, but the rent your LLC receives is taxable income. Thus you’d end up paying tax on that money twice: once as wage income and again as rental income (through the LLC). Not good.

Okay, but what about the LLC’s business expense deductions? Couldn’t that cover the rental income? Theoretically, sure, but the IRS has rules that prevent owners from benefiting from self-rental losses.

Plus, even if you manage to balance the scales –– creating absolutely no profit or loss from the LLC –– you’d still be creating long-term tax problems for yourself. First of all, if your LLC takes the depreciation deduction, that decreases the tax basis of your home purchase.

That means when you go to sell the property, you’ll pay more in capital gains taxes, as well as tax on the depreciation recapture. The tax burden can end up being quite significant.

On the flip side, by owning your house personally (not through an LLC), most people can sell their primary residences tax-free. Currently, individual homeowners can deduct up to $250,000 in capital gains from the sale of primary residences ($500,000 if married filing jointly).

All in all, it really does not make long term financial sense to rent your primary residence from your LLC.

Related Questions About Renting From Your Own LLC

Can I live in a house owned by my LLC?

As mentioned, the legal answer here is, yes, you can live in a house owned by your own LLC. However, the tax ramifications make this an unwise course of action for most people. Additionally, individual homeowners receive non-tax benefits of ownership such as state homestead exemptions and lower mortgage interest rates. Thus, living in a house owned by your LLC is generally not considered a best practice.

Can I rent my house to my business?

It’s possible to rent your house (or part of your house) to your business if your company is incorporated (S-corp or C-corp). This creates a tax write-off for your business. But on the personal side, certain self-rent rules apply, so it may not be as advantageous as you think. It’s best to consult a tax professional to determine what’s best in your specific scenario.

For sole proprietorships and LLCs, renting your house to your business falls under self-rental rules, and thus is not advisable. Instead, ask your tax professional about home office deductions on your personal income taxes to reduce self-employment tax.

Investing in real estate takes careful planning at every stage. Remember that New Western is here both to help you get started and to keep the momentum going. We work with individuals and LLCs to pinpoint the next right step in your investment strategy. Reach out to our team for more information today.